Off to the south, chasing the sun

The longing for summer, sun, beaches and sea could not be greater after the Corona-related restrictions of recent years. The beleaguered tourism industry breathed a sigh of relief and felt a clear rebound effect as early as the end of 2022. According to 1 , for example, travel spending in Germany doubled from EUR 28.8 billion in 2021 to EUR 58.6 billion, even though the first half of the year was still clearly marked by the restrictions. This was only a short distance from the previous record result of 2019, which trended at EUR 69.5 billion. At least for this year, Germans are not letting geopolitical uncertainties or high inflation slow them down.

Accordingly, 2 , booking sales in travel agencies and at online travel portals already show an increase of 12% at the end of January compared to the pre-Corona year 2019. The largest share of bookings since the beginning of the year, around two-thirds, is accounted for by the summer months between May and October. According to DRV President Norbert Fiebig, the travel market is undergoing a trend reversal. "People who want to go on holiday are again booking much earlier and taking advantage of the current early-booking discounts offered by travel providers." If the geopolitical conflicts do not spread to other regions, the current travel year 2023 should result in new records.

Looking to the future with optimism

Sebastian Ebel, CEO of travel group TUI, who has been in office since October 2022, is blowing the same horn as the president of the German Travel Association. Thus "the booking dynamics continue to be encouraging, also the demand for Easter vacations is high. Capacities for the summer can almost reach pre-crisis levels. We expect a good summer in 2023." Over 500,000 guests will travel with TUI over the holidays, and in the Easter vacations, the expected occupancy rate is around 95%, which is largely in line with pre-crisis levels. It was already revealed when the first-quarter figures were presented that bookings at the integrated travel group were around 10% higher than pre-pandemic levels in 2019, while prices were also higher.

TUI Group with Herculean task

That an easing in the travel market occurs after the devastating two fiscal years is existential for TUI AG, a leading global tourism group. TUI AG is the holding company of the TUI Group and directly or indirectly holds shares in the main Group companies that conduct the Group's operating business in the individual countries via associated companies. Overall, 268 direct and indirect subsidiaries were included in TUI AG's scope of consolidation at the end of the financial year on September 30, 2022.

of tour operator holidays are booked by Germans in travel agencies.

In this context, the Group, based in Hanover and Berlin, offers the entire tourism value chain under one roof for around 21 million customers. This includes 418 hotels and resorts with premium brands such as RIU, TUI Blue and Robinson as well as 16 of its own cruise ships, from the MS Europa and the MS Europa 2 in the luxury class and expedition ships to the Mein Schiff fleet of TUI Cruises and cruise ships at Marella Cruises in the UK. The Group also includes leading tour operator brands and online marketing platforms across Europe, five airlines with 134 medium- and long-haul aircraft and around 1,200 travel agencies. The TUI Group is divided into two core business areas: Vacation Experiences and Markets & Airlines.

Operationally geared to profitable growth

Due to the dramatic slump in 2020, the Group was forced to restructure in recent years to increase efficiency on the one hand by streamlining and, on the other hand, to cut costs drastically. As a result, the five airlines from Germany, the United Kingdom, Belgium, the Netherlands and Sweden were consolidated and run by a single management team. In addition, around 55 of the approximately 450 Group-owned stationary travel agencies in Germany closed, with others following in the UK and Switzerland. The reorganization of sales had already occurred under former company leader Fritz Joussen, who focused primarily on digital platforms and stronger direct contact with customers, including via new apps.

should be the adjusted EBIT for fiscal year 2025/2026.

It will continue under the former CFO and now CEO, Sebastian Ebel. TUI is to grow profitably and gain market share by expanding its product portfolio in the Markets & Airlines segment. For example, classic package tours are to become more diverse and flexible, and individual travel products will be offered separately in the future rather than as part of an all-inclusive package as usual. In addition to city breaks, this also includes the separate offer of only flights, hotels or rental cars, or experiences from the TUI Musement business unit, such as day trips at the vacation destination or museum visits.

The Company also wants to grow in the Hotels & Resorts business unit. Here, the focus is not necessarily on owning the property, as in the past. Instead, joint ventures are being sought in order to be able to handle the expansion with management and franchise partners. However, the TUI App is to act as the central hub in the future to link the strengths from all segments and ensure additional growth. 3 This puts the Company in direct competition with the top dogs such as Booking.com or Expedia. Whether market penetration is successful here and whether the turn to digitalization has not come too late can at least be critically questioned.

Partial debt reduction is the goal

In addition to operating growth - the Group plans to increase adjusted EBIT to well over 1.2 billion as a medium-term target for 2025/2026 - the main focus will be on reducing the

the utilization rate of aircraft at TUI Group over the Easter vacations.

enormous debt burden, refinancing, and strengthening the balance sheet. In order to reduce the crushing interest burden, TUI paid around EUR 300 million in interest by the end of the expired fiscal year ending September 30, 2022, due to the stabilisation measures of the

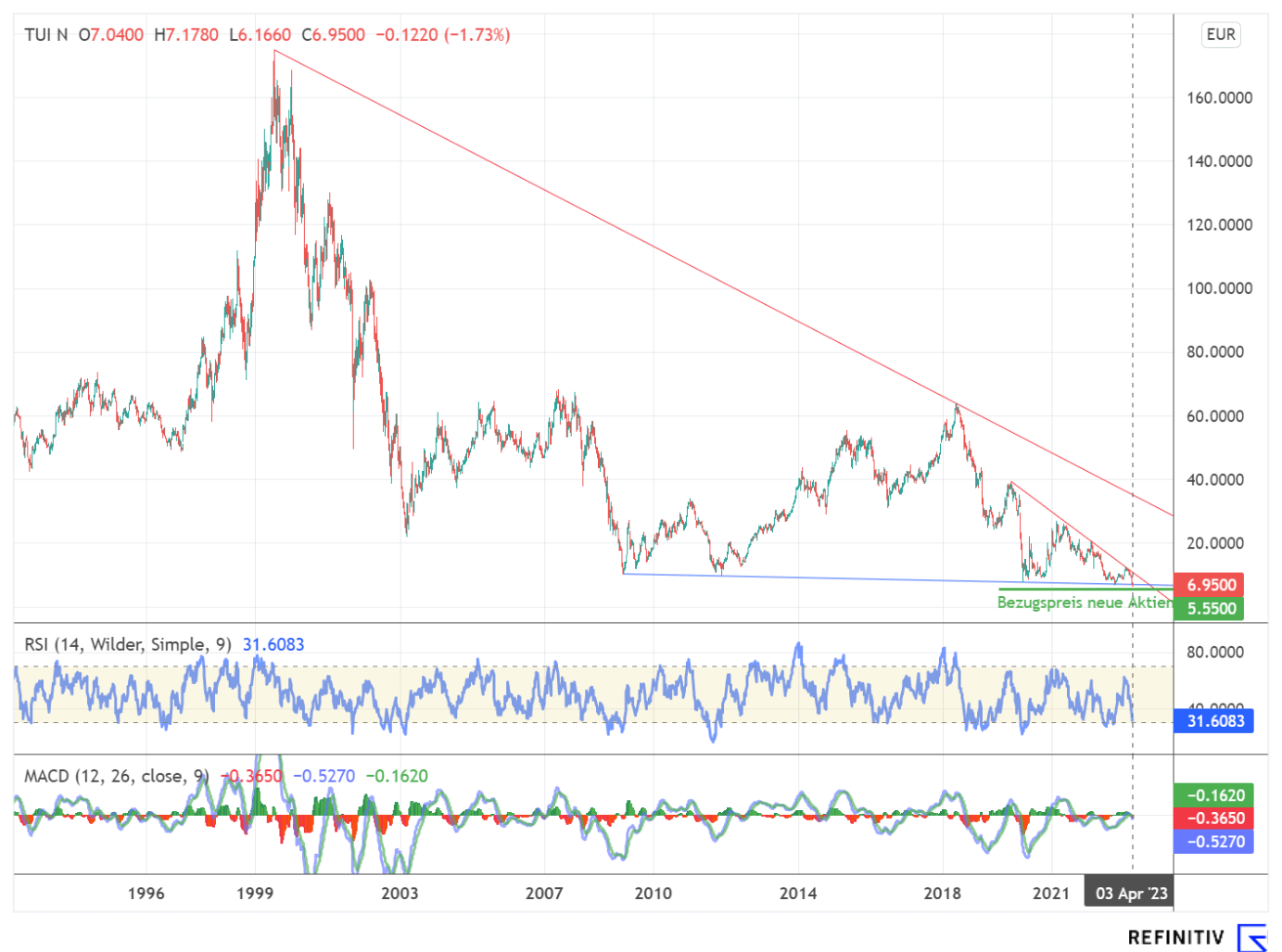

Economic Stabilisation Fund ESF, a capital increase with subscription rights was resolved following the successful implementation of the 10:1 reverse stock split, which was approved at the 2023 Annual General Meeting. Thus, from March 28, 2023, to April 17, 2023, 328.9 million new registered common shares with no par value will be offered at a subscription ratio of 3:8. The subscription price is EUR 5.55. The Company will thus receive around EUR 1.8 million in gross proceeds. According to a TUI spokesperson, this is considered certain, as the underwriting banks would take over the shares not placed.

It remains critical

Every investor should be aware that this horrendous capital measure and the enormous dilution of the existing shareholders - the share package of the sanctioned major Russian shareholder Alexei Mordashov falls from 30.91% to just under 11% - is only a drop in the ocean and a partial debt relief. TUI AG is far from being out of the woods. The capital raised would reduce interest costs by EUR 80 to 90 million per year; net debt was a horrendous EUR 5.3 billion as of the end of December 2022, according to Reuters Refinitiv, and would thus be reduced to around EUR 3.55 billion. By contrast, looking at analyst consensus forecasts for profit, EUR 434 million is expected for the current fiscal year 2023, and EUR 565 million for 2024. To further reduce debt and thus the interest burden, it would not be surprising if further capital measures on a larger scale were to follow.

Risks loom from several sides

The fact that there is a great desire to travel and to travel to distant countries after more than 2 years in Corona prison can be seen from the current booking figures. Thus, as expected by the industry, despite uncertainties due to the geopolitical situation and the Ukraine war, as well as a further high inflation of 7.4% in March, the year 2023 should mutate into a record year. We are skeptical that this euphoria will be sustained beyond the end of the year due to the continued high cost of energy and living expenses. If inflation remains at least at the current level - we expect significantly higher prices for energy costs alone following the current correction - this is likely to diminish the purchasing power of citizens further and thus their desire to travel. Rising aircraft and ship fuel prices could also lead to cost increases and margin collapses at TUI, although a hedging strategy has always been used to counteract such influences. Another risk that should not be underestimated is the spread of geopolitical tensions in Ukraine to other countries.

SWOT analysis

Strengths

- Established brand

- Coverage of the complete tourism value chain

- Profitable growth opportunities through cross-selling

- High asset value

Weaknesses

- Strong competition from abroad (Booking.com, Expedia, Airbnb)

- Conversion to digital comes too late

- High level of debt

Opportunities

- Digitization

- More flexible business model

- Expansion into further countries

Threats

- Higher interest burden due to rising interest rates in the overall market

- Package tours going out of fashion

- External events (war, pandemics, terror)

- Rising energy costs

- Personnel bottlenecks

Uncertainties prevail

Due to the Corona pandemic, the tourism group got into economic difficulties through no fault of its own. Without government aid, survival from its own resources would have been impossible. As a result of the restructuring measures taken during the pandemic, TUI AG now presents itself as leaner and more flexible, and the Company is also increasingly focusing on digitization. However, we are doubtful that this will be a resounding success. If we look at the peer group, there are already platforms such as Booking.com or Expedia that have successfully relied on the digital model from the beginning. In our opinion, predatory competition is unlikely to take place in this segment.

Similarly, we believe that the euphoria for package tours will likely subside sharply in the near future due to the high loss of purchasing power among citizens, especially in Germany. As a result, the profits forecast by analysts are likely to be revised downwards. On the other hand, what remains high is the high level of debt, even after the monster capital increase, which is difficult to pay off from operating funds alone. Thus, the current capital measure will likely not be the last. After the strong sell-off of the share as well as the subscription rights, short covering with high volatility occurred last week. These high fluctuations will likely continue until the subscription period ends. Certainly, profits are possible in the short term for hardened traders. In the long term, the downward spiral that began in 1999 will likely continue. Thus, prices below the subscription price of the capital increase are not unlikely.