Shared market power

Wide range of applications

Potash is an important nutrient used in the manufacture of fertilizers. In this process, the potash component compensates for deficiencies in the soil. As a natural mineral, potash is an essential nutrient that increases water-holding capacity, disease resistance, and overall plant productivity. In addition to agriculture, potash is also used in industry for recycling, water treatment and photographic chemicals.

The global market for potash fertilizers was approximately $26 billion in 2020. It is expected to grow at a CAGR of 4.66% to $36.7 billion by 2028.1 Total global potash reserves are estimated at 210.0 billion tons of potash oxide, of which 16.0 billion tons can be mined with existing technologies. Of the 16 billion tons, 10.0 billion tons are located in Canada, most of which is in the province of Saskatchewan. Russia and Belarus have 2.2 billion and 1.0 billion t, respectively. Thus, the three countries dominate global potash deposits and directly influence fertilizer prices. In the United States, about 85% of potash is imported from Canada, with only a small portion produced in Michigan, New Mexico and Utah. 2

| Name | Code | Market capitalization in USD billion | Enterprise value in USD billion | Sales 2021 in USD billion |

|---|---|---|---|---|

| Nutrien, Canada | NTR | 58,10 | 69,23 | 26,86 |

| Mosaic, USA | MOS | 24,53 | 28,81 | 12,36 |

| ICL, Israel | ICL | 15,30 | 17,79 | 6,96 |

| K+S, Germany | SDF | 6,01 | 6,44 | 3,80 |

| Uralkali, Russia | URKA | 3,27 | 7,66 | 4,15 |

| Belaruskali, Belarus | only bonds issued | k.A. | k.A. | k.A. |

As the table shows, K+S is hardly indebted to Belaruskali, Uralkali or even Nutrien.

Market in few hands

In addition to geographic concentration, production at the corporate level is also spread across just a few shoulders, producing more than two-thirds of the potassium carbonate mined annually. The world's largest producer is Canadian company Nutrien, which produces more than 25 million metric tons of potash, nitrogen and phosphate products worldwide for customers in the agricultural, industrial and feed industries and has a conglomerate with the US-based Mosaic Group. According to the most recent figures from the end of 2019, the two North American partners produced just under 30% of the 65.5 million tons of potash mined in the full year. Uralkali as well as Belaruskali, on the other hand, were responsible for 18% and 16%, respectively.3

Due to the current flare-up of geopolitical tensions and the sanctions against companies from Russia and Belarus, supply shortages are taking on a new importance and new potential for Western producers such as Germany's K+S AG.

To address the supply shortage and security of supply, Nutrien, the largest producer, announced last week that it plans to increase potash production capacity to about 15 million tons in 2022 in response to uncertain potash supplies from Eastern Europe. That is an increase of almost 1 million tons compared to earlier expectations. 4

Focus on the essentials.

An estimated 8% of the world's potassium carbonate comes from the fifth-largest producer, Germany's K+S AG. The Kassel-based company can look back on a long history. As early as the middle of the 19th century, the first fertilizer factories were established in Germany, which were initially responsible for the production of phosphate. Relatively quickly, the importance of potash as an effective mineral fertilizer was recognized, which, in combination with phosphate and nitrogen, significantly increased crop yields and led to a revolution in agriculture in the years that followed.

net financial debt could be reduced in 2021.

The commercialization of fertilizers began with the founding of the "Aktiengesellschaft für Bergbau und Tiefbohrung" in Goslar, which later became Salzdetfurth AG (1899), the oldest predecessor of today's K+S AG. Until 1970, today's K+S AG, marked by several wars and economic crises as well as splits in East and West Germany, was a pure fertilizer and potash producer. In order to remain competitive, Salzdetfurth AG and Wintershall AG merged their potash and rock salt activities into the newly founded "Kali und Salz" under the umbrella of BASF. After reunification in 1989, the potash and rock salt activities of East and West Germany were combined in "Kali + Salz GmbH".

Two-pillar strategy as a success factor

Since then, the MDAX-listed company has focused on its two-pillar strategy. On one side was the potash and magnesium business; on the other, the salt business. In the process, K+S became the leading global salt producer with the acquisition of South America's largest salt producer Sociedad Punta de Lobos in 2006 and finally of the US company Morton Salt in 2009. The potash business was boosted by acquiring the Bethune potash mine in Canada for about EUR 3 billion. Growth had its price, K+S AG groaned under a high mountain of debt. As a result, net financial liabilities stood at EUR 3.1 billion at the end of 2019, debt reduction stagnated, and the rating agency Standard & Poors only graded the Company's creditworthiness as "BB-" and thus at junk level.

The salt in the soup

The management around CEO Burkhard Lohr had to act and decided against selling the capital-intensive potash mine, but instead to abandon the salt business in North and South America and focus entirely on the core business with potash and magnesium products. The sale of the US subsidiary Morton Salt for EUR 2.6 billion to the American company Stone Canyon in April last year was a liberating blow. The remaining salt activities in Europe, which are expected to contribute around EUR 70.00 million to total earnings, are also no longer strategic and, according to management, could also be sold, although not at any price.

Overall, the Company's leader is clearly focusing on optimizing the existing business, expanding and developing the core business and opening up new business areas. In addition, the topics of digitalization and automation are to play an even greater role along the entire value chain. 5

New business area with earnings effect

K+S sees enormous potential and a rapidly growing market in the segment of sustainable and responsible waste management solutions. As a result, the disposal activities have been brought into the joint venture REKS, a joint venture between K+S AG and REMEX, a subsidiary of the REMONDIS Group with a strong sales network. In doing so, the partners aim to develop the flourishing European market for the recycling and disposal of waste and the realization of sustainable waste management solutions. As a result of the contribution of the K+S shares to REKS, which is to be consolidated at equity, K+S generated a one-time income of approximately EUR 200 million in the fourth quarter of 2021. In addition, a total cash inflow of approximately EUR 90 million before taxes was generated.

Paradigm shift in the past financial year

The successful sale of the American salt business and the restructuring of the Group were unavoidable due to the high debt burden. In addition, of course, the enormous demand from the agricultural sector and the consequent steady rise in potash prices boosted earnings and cash flow. In total, earnings forecasts were significantly adjusted three times.

the EBITDA Marge 2021.

In addition, the key financial figures already show that the CEO's goal of making the Company more efficient, leaner and more profitable is bearing fruit.

Sales grew by 32% to EUR 3.2 billion in the past fiscal year. In the Agriculture customer segment, sales increased by 34% to EUR 2.3 billion in fiscal 2021 (2021: EUR 1.7 billion). This was mainly due to significantly higher average prices of around 28% and the increase in sales volume by about 300,000 tons to 7.62 million tons. The Industry customer segment reported a 29% increase in sales to EUR 941 million in 2021. In particular, strong demand in the de-icing salt business and the chemical industry and higher prices for industrial potash were responsible for the positive development.

By contrast, EBITDA, including the special income from the REKS joint venture described above, exploded from EUR 267 million in the same period last year to a current EUR 969 million. The development of the EBITDA margin from 12% in the previous year to 30.2% in 2021 is encouraging here. Adjusted earnings per share amounted to EUR 11.61 after a high loss of EUR -9.42 in 2020. The equity ratio rose to 60.6% after the Americas sale from 26.5% in the previous year. In addition, the Executive Board and Supervisory Board intend to propose a dividend of EUR 0.20 per share at the Annual General Meeting on May 12. 6 Also positive is the fact that in September 2021, the rating agency Standard & Poor's upgraded its rating from B to B+ with a "stable" outlook.

| Figures and estimates 2020 to 2023 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| Sales in EUR billion | 3,70 | 3,21 | 4,68 | 4,15 |

| EBITDA in EUR billion | 0,45 | 0,96 | 1,90 | 1,37 |

| Earnings per share in EUR | -9,42 | 11,61 | 6,55 | 4,95 |

| price-profit ratio | neg. | 2,37 | 4,35 | 6,42 |

Forecast significantly expanded

K+S also expects a strong increase in operating earnings EBITDA between EUR 1.6 billion and EUR 1.9 billion for the current fiscal year 2022. Thus, the management sees a continued favorable market environment in the Agriculture customer segment and assumes a strong increase in the average price in the product portfolio. Sales volumes are also expected to increase slightly once again. Against this background, adjusted free cash flow should also rise sharply to between EUR 600 million and EUR 800 million.

EBITDA would mean the best result in the Company's history in 2022.

"With the above-mentioned range, we would generate the best result in our company's history. Even in view of the war in Ukraine and the associated dynamics in sales prices and energy risks, we are sticking to this forecast, " said Lohr at the annual press conference. In the annual report, the CEO also addressed the longer-term goals. Thus, from 2023 onwards, the K+S Group as a whole and each individual plant should generate a positive free cash flow even if potash prices are temporarily low. Over a 5-year cycle, the cost of capital is to be earned with an EBITDA margin of more than 20%.

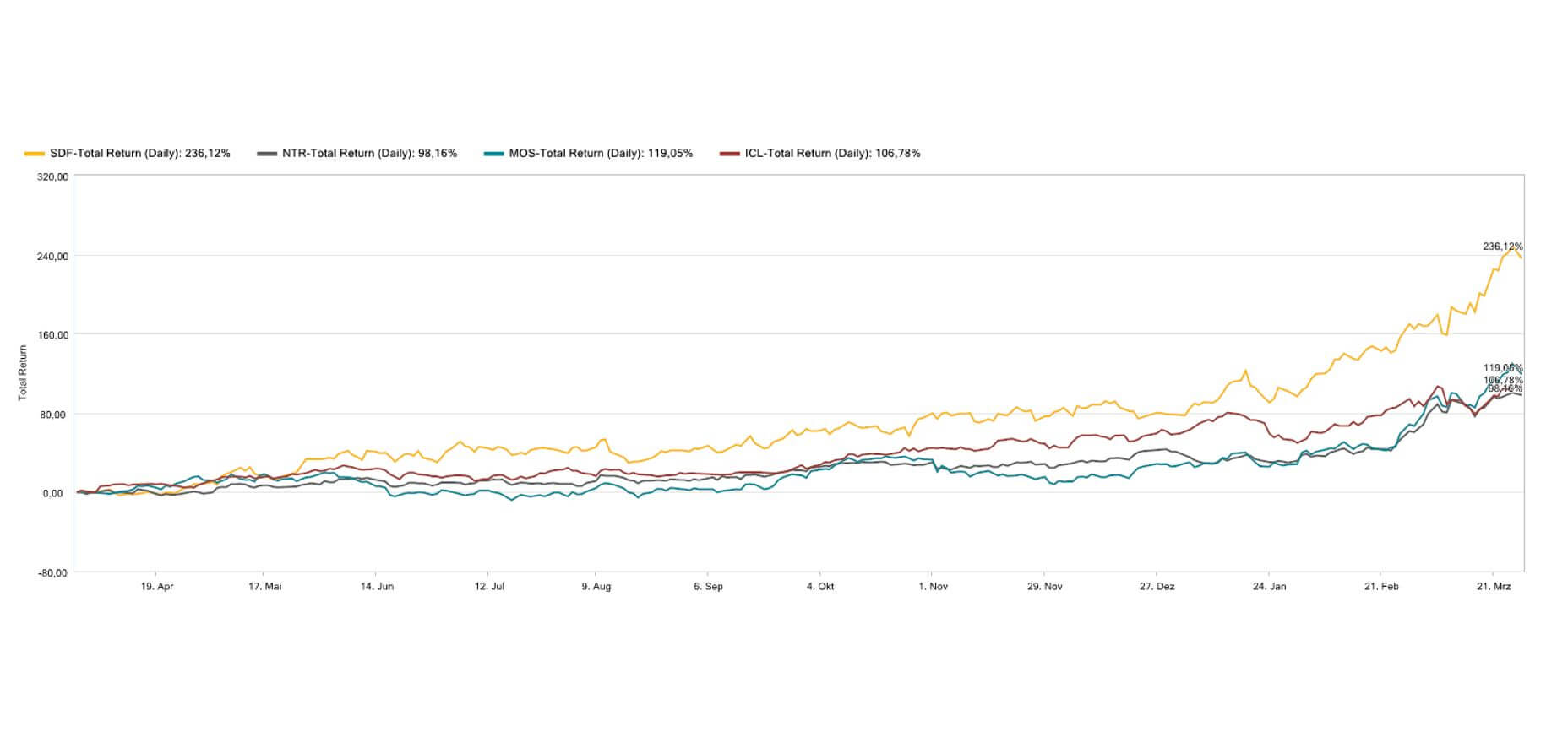

Well-positioned in the growth market

Due to the current geopolitical turmoil, various commodities are exploding and are in exaggerated phases. This can also be seen on the potash market at the moment. The K+S share has also been running hot. After a six-fold increase in the share price from the Corona low of EUR 4.50 in March 2020 to prices around EUR 30, a correction is needed, but this appears healthy for the further development in the long term. For the future, important decisions were made last year at the fundamental level. As a result of the sale of the American salt business and significant cost reductions, net financial debt was reduced by 82%. With the future focus on the profitable potassium and magnesium business and the growing global demand for fertilizers, the Company is on solid footing for the future. Demand for fertilizers will continue to rise as a result of the growing world population, while supply is in short supply. The sanctions against the two producers from Russia and Belarus will significantly widen the excess demand. As a result, K+S, as one of the largest producers in Europe, should benefit significantly. Due to the uncertain situation as a result of the Ukraine conflict, analysts' opinions also diverge widely. Thus, the price targets in the analyses, which were made in the past 2 weeks alone, ranged from EUR 20.50 by Morgan Stanley to EUR 33.00 by the analyst house Stifel Europe. 7