At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Kommentare von Nico Popp

Kommentar von Nico Popp vom 03.08.2022 | 05:00

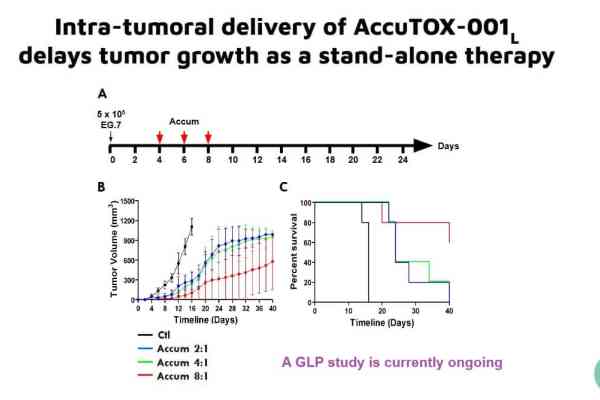

Stock news: AccuTOX™ - New project from Defence Therapeutics against cancer cells

Vaccinations against various types of cancer and drug boosters that are suitable for reducing the effective doses of drugs - this is what Defence Therapeutics stood for, until yesterday. Now the Company has expanded its portfolio: the active ingredient AccuTOX™ ensures that cancer cells die. A Phase 1 trial is planned for 2023. Find out what the new application means and how the Company is otherwise positioned in our update.

Zum KommentarKommentar von Nico Popp vom 27.06.2022 | 06:00

Stock news: Defence Therapeutics - analysts with new study

In order for markets to function efficiently, theory presupposes a comprehensive level of information among all players involved. But in practice, things sometimes look different: When education is no longer sufficient to understand companies' products and methods, an information deficit arises. The market then also no longer functions efficiently, and market anomalies occur. Especially around biotech stocks, investors repeatedly have problems understanding products, solutions and interrelationships. In the case of Defence Therapeutics, the analysis firm Canaccord Genuity is now shedding comprehensive light on the situation. For investors with insight, this can be an opportunity.

Zum KommentarKommentar von Nico Popp vom 15.02.2022 | 07:00

XPhyto consistently implements 3-pillar strategy

At the beginning of December last year, we took an in-depth look at the Canadian biotech company XPhyto Therapeutics. The in-depth report looked at the three divisions - Diagnostics, Innovative Dosage Forms and Psychedelics - and put the business in the context of the overall market. In the meantime, a lot has happened at XPhyto: the Company has published an update on the individual business areas and announced news around its activities in rapid PCR-quality corona tests. Reason enough for an update.

Zum KommentarKommentar von Nico Popp vom 08.02.2022 | 06:01

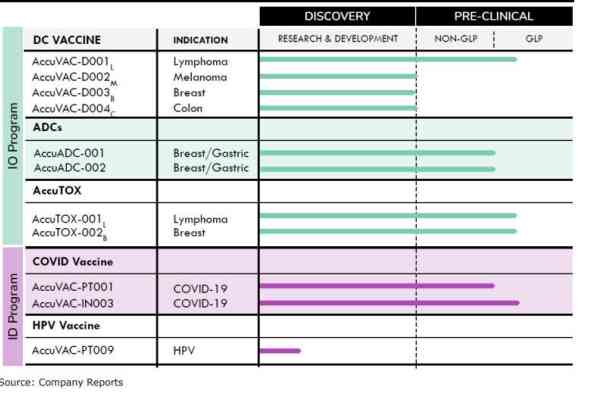

Stock news: Defence Therapeutics facing collaborations

After years of hype, the prices of the best-known biotech shares have also fallen recently. The Canadian cancer hopeful Defence Therapeutics (ISIN: CA24463V1013) has also lost ground in recent months. Yet the Company is on a strong course. Defence Therapeutics has patented Accum™, a technology for drug conjugates, which it also uses for vaccinations. Two Phase 1 trials are scheduled to start against breast and skin cancer this year. In addition, Defence Therapeutics has another iron in the fire with a vaccine against human papillomavirus (HPV). As Defence CEO Sébastien Plouffe points out, some major industry players are already showing interest in collaborations. An update.

Zum KommentarKommentar von Nico Popp vom 14.12.2021 | 05:02

Defence Therapeutics - Tech innovator fights cancer

Vaccines against cancer and improved transport of active substances into tumor cells - the Canadian biotech company Defence Therapeutics promises no less with its patented technology. In the next six months, Defence Therapeutics intends to prove that its vaccines are safe in Phase 1 trials. That finding could be a liberating blow for the company. Read our research to find out what else makes the biotech tick and why the stock is entering an exciting phase.

Zum KommentarKommentar von Nico Popp vom 07.12.2021 | 05:02

XPhyto Therapeutics - Three hot irons in the fire

Early-stage biotech companies rarely provide detailed insights into their universe. It is not surprising, as the market for diagnostics in the context of Covid-19, in particular, is highly competitive. The company featured here, XPhyto Therapeutics Corp. is reportedly preparing to take off in the coming weeks and months in not one but two of three business areas. Specifically, it is looking at precise and rapid PCR testing that does not require a traditional lab and promises results in 25 minutes. But it is also about testing methods for other typical diseases. Regarding medications, the provider presented here is working on procedures to improve their effect on patients and even produce them more cheaply. The following report on biotech summarizes which company XPhyto wants to catch up with in the long term and the market potential. An insight into a very dynamic market.

Zum KommentarKommentar von Nico Popp vom 30.11.2021 | 05:01

Nordex - good business, weak margin

For years, the climate and energy turnaround has determined events in the economy. Since the coalition agreement of the upcoming German government was presented, it has become clear that sustainability and renewable energy sources will become even more important in the future. Reason enough to take a closer look at the shares of wind turbine manufacturer Nordex. Can shareholders now hope for a significant boost in demand? What role do sluggish approval procedures play in operational progress on the German market? Which global markets are gaining in importance? How can we succeed in boosting the still relatively weak margins in times of raw material shortages? Answers to these and other questions are in the following article.

Zum Kommentar