New coalition agreement - full speed ahead

Despite the secrecy of the protagonists, the coalition negotiations between the Social Democrats, the Greens and the Liberals were also marked by conflict: While the Greens called for more sustainability, the FDP worried about state budget and freedom. The SPD also found it difficult in some cases to allow the change pushed by the smaller parties. The bottom line, however, according to many observers, is a paper that combines the goals of the three parties well and with which the economy can also live.

the share of wind farms in the German energy mix is to double between 2030 and 2045 - after an increase of 50% from today to 2030

In the area of climate protection, the coalition partners are aiming to phase out coal ideally as early as 2030. Wind and solar energy are to compensate for the dwindling supply. According to the coalition agreement, around 80% of energy is to come from renewable sources by 2030. **With regard to wind energy, 2% of the federal territory is to be reserved for wind power projects. Wind farms at sea are to supply 50% more energy by 2030 than previously planned, namely 30 instead of 20 gigawatts. By 2045, this figure is to double again to 70 gigawatts.1 What does this expected surge in demand now mean for Nordex?

Market share in Germany

In 2020, Nordex had a market share of around 30% of newly approved MW in Germany, according to the company's figures. 2 The company's market share in Germany has steadily increased over the past few years. With the market position it has now achieved, Nordex is likely to be one of the biggest beneficiaries of the new German government's plans. But how realistic is it that these plans will be implemented? According to the German Wind Energy Association, a wind energy project currently takes between four and five years to be planned and approved. 3 However, the new federal government also wants to take action here and halve the duration of corresponding approval procedures. Digital processes and interdisciplinary working groups are to help. However, it remains to be seen to what extent these plans can be implemented in the time envisaged. The digitization of the German administration is unlikely to be a project that can be completed within one legislative period.

Nordex: political plans "very ambitious"

Nordex itself takes a positive view of the climate targets set by politicians, describing them as "very ambitious". When asked: "Our company is prepared for this development and provides our customers with a selection of highly efficient turbines that can optimally serve the market in Germany (among other markets). It is now up to policymakers to create a framework to leverage the growth potential in the long term. In addition to new land, simplified and faster approval processes, harmonization of environmental regulations and further promotion of acceptance among the population plays an important role here," a company spokesman told researchanalyst.com.

Given the ambitious plans of the next German government and Nordex's high market share in Germany, the company should benefit from the new framework. However, as approval procedures in Germany have been relatively slow so far, Nordex will remain dependent on new business in other international countries. With Europe accounting for 54% of sales, North America 22% and Latin America 17%, Nordex's business appears sufficiently diversified.4 With other governments also promoting or making their own investments in renewable energy, Nordex has a good outlook.

International business and new markets

Nordex Group has plants in Germany, Spain, Brazil, the United States, India and Mexico. Given the regulatory environment in Germany, international markets play an important role. The company is currently expanding its production capacity for rotor blades and turbines in India. Due to delays in the wake of the pandemic, the measures are currently around three months behind schedule. The company does not expect sales in India anyway due to the current weak market environment. Things are currently going better in Peru.

Special features of the Peru order

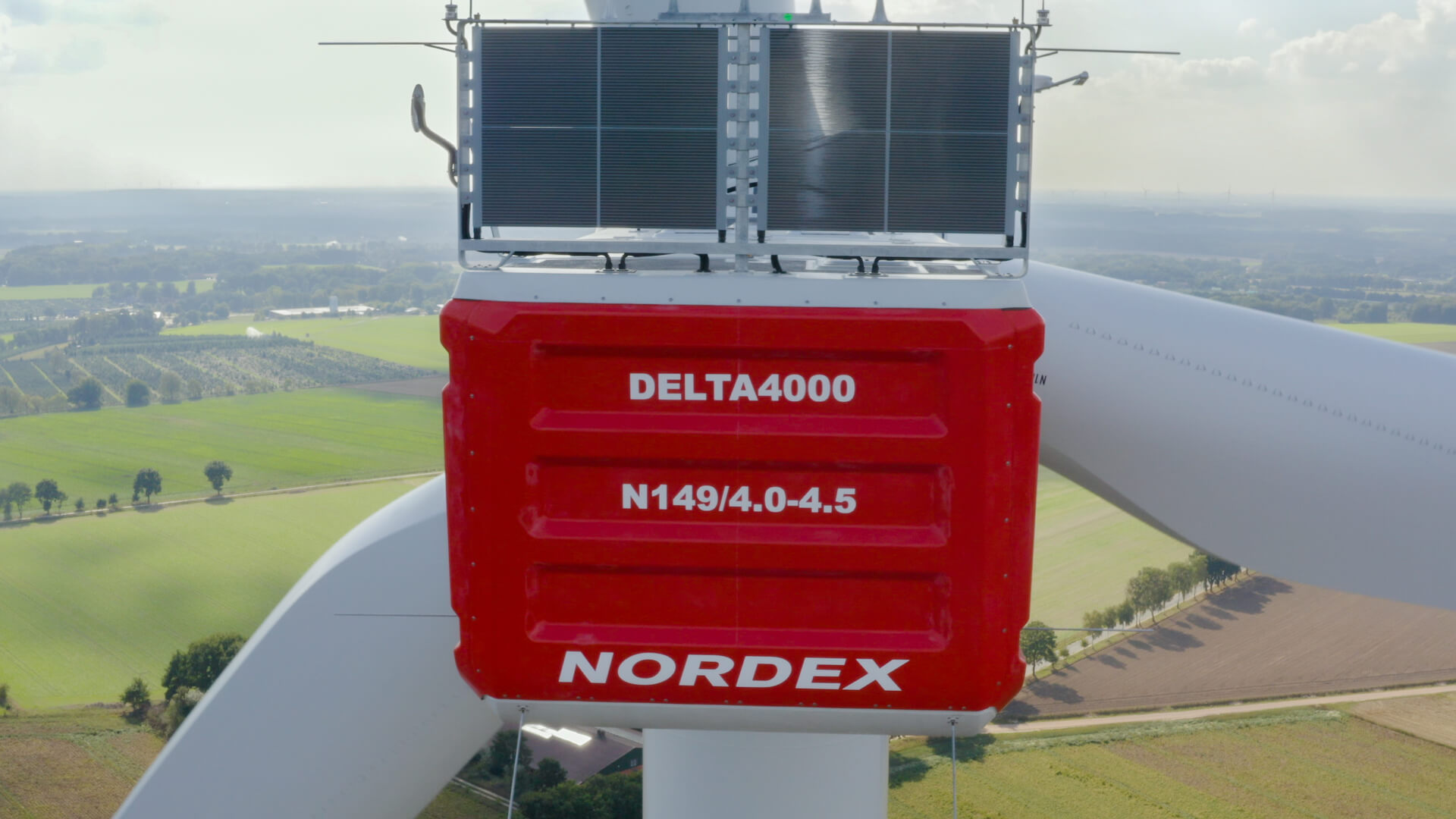

Nordex recently announced another order from the South American country. It involves a 177 MW wind farm for an unnamed customer. The project is unique in that it is the first order for N155/5.X turbines of the Delta4000 series with a rotor diameter of 155 meters and variable rated power. In addition to the delivery, Nordex secured a service contract with a long term of ten years. Nordex plans to start construction as early as autumn 2022 - Given Germany's long planning times, the key data for the latest order from Peru underscores the great importance of international business.

Good prospects in Turkey

However, it is not only in Peru that things have been going well for Nordex recently: in November alone, the company reported further orders, such as a 44 MW order in France brokered by RWE and 68.4 MW from Turkey. In the middle of the year, Nordex's market share within Turkey stood at 28.6%. The company says its operations in Turkey are expected to reach 3.5 GW of capacity by early 2022, comprising more than 1,100 turbines. 5

Problem children: raw material shortages and margins

Nordex has recently cashed in on the EBITDA margin and expects only 1.0% for 2021.

Although Nordex's business stands on several regional pillars, analysts also see risks. These lie primarily in rising commodity prices and the resulting dwindling margin according to market observers. The company had originally targeted consolidated sales of between EUR 4.7 billion and EUR 5.2 billion in 2021, with an EBITDA margin of 4.0% to 5.5%. A significant contribution to the rising margin was expected to come from the new Delta4000 platform, which is considered more efficient and of increasing importance to Nordex. However, ongoing cost pressure has put a spanner in the plans for 2021: Now, Nordex expects sales at the upper end of the guidance, but only an EBITDA margin of around 1.0%.

Delta4000 will soon no longer be attractive

The company also continues to rely on its Delta4000 platform. When asked, a company spokesperson commented to researchanalyst.com: "Of course, the sustainable improvement of profitability is one of the essential goals of our management, in which the high and increasing share of the Delta4000 platform will play its part. It is expected that the share of Delta4000 platforms in 2022 will be higher than the previous year due to higher expected production and installation numbers."

| Company | EBITDA-Margin 2021e |

|---|---|

| Nordex | 1,0% |

| Vestas Wind | 11,36% |

| Siemens Gamesa Renewable Energy | 3,98% |

| Legrand SA | 23,73% |

| Nexans SA | 12,18% |

| Dongfang Electric Corp. | 21,9% |

As a result, the EBITDA margin could increase slightly again in 2022, but in the long term, the new platform is likely to have less and less potential to have a positive impact on the figures, as Delta4000 is already the dominant platform at Nordex - already in 2020, 81% of new orders were for Delta4000.6

Look at the numbers

Increased Nordex sales in the first nine months of 2021.

The first nine months of the year were pleasing for Nordex in terms of sales - business grew by around 25% to EUR 3.9 billion. As a result, earnings before interest and taxes also increased significantly to a loss of only EUR 9.6 million in the period under review. In the first nine months of the previous year, this figure was still EUR 43.9 million. However, since Nordex was last in the black in 2017, a relatively high debt ratio is now also causing an interest burden: In the first nine months of 2020, EUR 98 million was incurred for debt servicing alone. The bottom line is a loss of EUR 104 million.

On the positive side, however, Nordex already recognized the high debt ratio as a problem in the summer and parts of a capital increase of EUR 568 million were used for debt service. Thus, the interest burden should tend to decrease in the coming quarters.