The Supreme Court's rejection involves the failure to review a decision by the federal appeals court. This held that federal law on insecticides, fungicides and rodenticides does not take precedence over state tort law. Since the US Supreme Court now explicitly does not address this, lawsuits like Edwin Hardeman's become cases for lower instances in the US states.1 Thus, glyphosate damage claims for the Leverkusen-based company go into numerous next rounds. Because: the possible lymphoma, perhaps caused by the pesticide, takes about five to ten years to break out.

Lack of warning labels on Roundup products

The US Supreme Court judges thus indirectly award EUR 23.68 million (USD 25 million) to Edwin Hardeman. Hardeman sued Bayer back in 2016, arguing that the glyphosate-containing product Roundup did not contain any warnings about carcinogens.2 The jury at the time ruled in his favor and awarded him EUR 75.78 million (USD 80 million). The amount was originally adjusted to EUR 18.94 million (USD 20 million) on constitutional grounds. Hardeman appealed this decision.

The core question of the appeal: Is the right to compensation of a victim with personal injury (Hardeman) excluded by misconduct (non-labeling of the product) of a company (Monsanto/Bayer) if the responsible US authority EPA confirms that glyphosate is not carcinogenic?

EPA so far considers glyphosate not carcinogenic

The Environmental Protection Agency (EPA) is an independent executive agency of the US federal government that deals with environmental protection issues. Accordingly, if a US agency demonstrates in scientific studies that the active ingredient glyphosate does not cause cancer, there is no need for special health labeling on Roundup products used by private customers such as Hardeman. No evidence of cancer, no labeling requirement, no wrongdoing by the corporation, and so the argument goes.

US District Judge Vince Chhabria of San Francisco emphasized that it does not interfere with a customer's right to sue for illness or other harm caused by the herbicide. Chhabria approved the settlement. Because the US Supreme Court rejected Bayer's appeal, the Company is drawing its conclusions. The "5-point plan" presented in May 2021 takes effect. Bayer has set aside an additional EUR 3.8 billion (USD 4.5 billion) to cover the expected claims of plaintiffs such as Hardeman in settlements and lawsuits. 3

Glyphosate active ingredient still in use in B2B segment

Beginning in 2023, Roundup products will be sold to residential customers with an alternative active ingredient instead of glyphosate. However, 90% of the Group's largest sales of the pesticide will continue to come from B2B sales to farmers. There, the product continues to be used in its previous formulation.

June 17, 2022: EPA must re-evaluate the health risks of glyphosate

Whether Bayer can rely on the EPA in the future is questionable. On June 17, 2022, another court ruled that the EPA's statements were unlawful, siding with the US Center for Food Safety CFS.4

In a 54-page decision, the court unanimously agreed with the challenge plaintiffs' arguments that "EPA failed to adequately consider whether glyphosate causes cancer and evaded its duties under the Endangered Species Act."5 In this regard, Amy van Saun, senior attorney at CFS and lead counsel in the case, explains, "Today is a monumental victory for farm workers, wildlife, and the public. The court ruled EPA's approval of Monsanto's glyphosate unlawful and chided EPA for ignoring real-world evidence of cancer risks from glyphosate use and not even considering impacts on endangered species."

Interim Conclusion

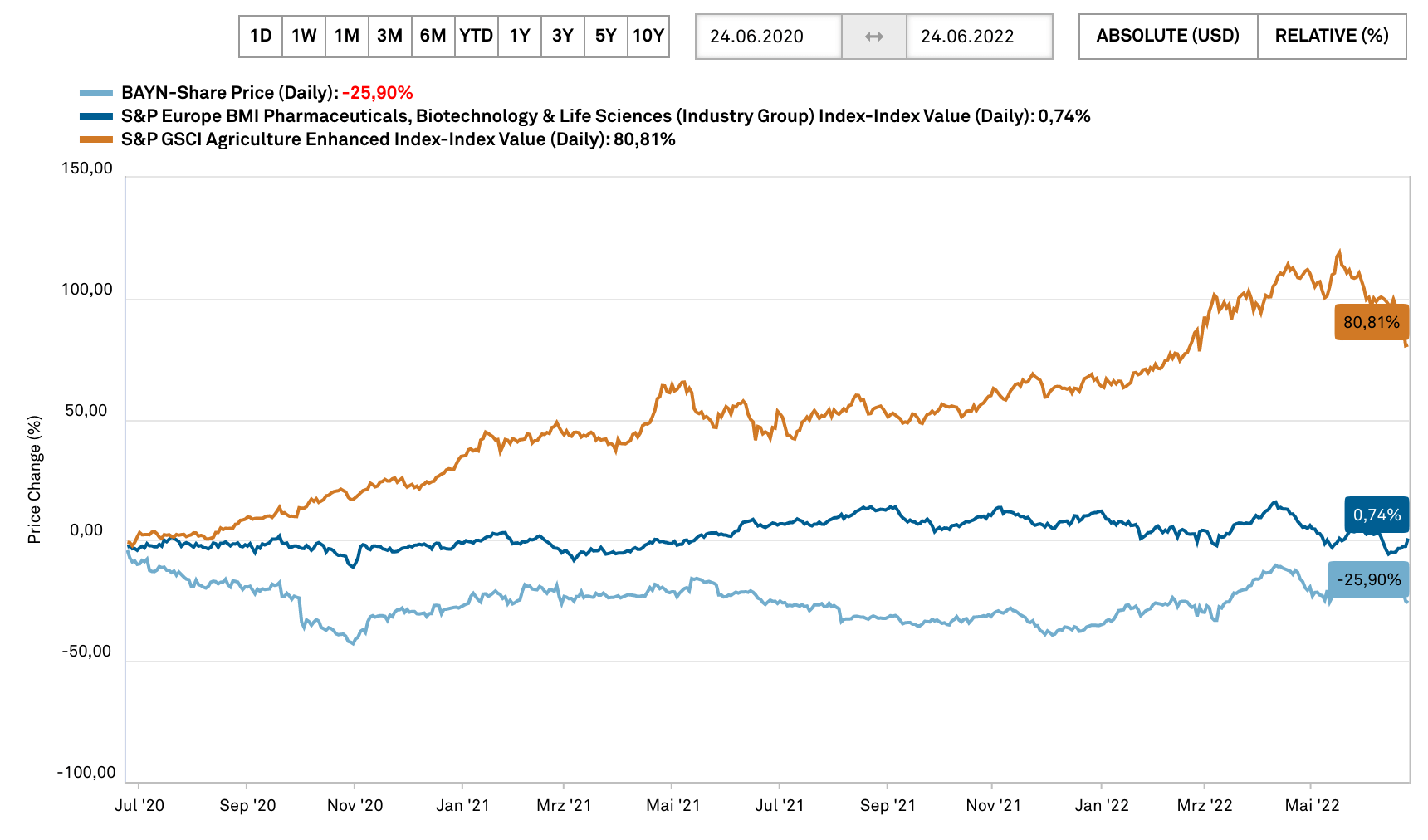

Since the acquisition of Monsanto in 2016 for about EUR 56.83 billion (USD 60 billion), Bayer AG's stock market value has fallen by a third.6 Bayer has set aside EUR 3.8 billion for the Monsanto lawsuits filed by private users. There is no end in sight to the lawsuits due to the US Supreme Court decision. In addition to the tarnished brand image, the Group needs to catch up in its other divisions, such as Life Science and Consumer Health, to rebalance the high expenses of the Monsanto deal. It also raises questions for investors as to why CEO Werner Baumann opted for the Monsanto purchase, apparently despite doubts and criticism within the Company.

In the Pharmaceuticals Division, Bayer received approval for Xarelto in Japan. Sales of the blood thinner have stagnated in other countries such as China due to expiring patents. The expiration allows a market for generics, drugs with the same active ingredient that can be prescribed by doctors and are priced much lower than branded products. Bayer has some new drugs on the market focused on cardiovascular, kidney disease and prostate cancer (Nubeqa). These could provide good sales.

Outlook

To what extent investors will forgive the image damage around Monsanto remains to be seen. The share price for the Leverkusen-based company will score points in particular with solid results. The gas crisis in Germany and its impact on the profitability of Bayer AG's related domestic production sites as well as the Ukraine conflict may affect the European business, but Bayer is a global player. The CEO has yet to clarify whether the purchase of Monsanto in 2016 really pays off in terms of expense and benefit - and he has to do so in front of both his team and shareholders.

The update is based on the initial Report 04/22.