Jeffrey Ubben has a mission. With his investment firm Inclusive Capital Partners, he wants to encourage companies to make environmental and social improvements in order to increase their returns. He does this by any means necessary. A month ago, Ubben told the Financial Times 1 of his displeasure with current Bayer AG Chairman and CEO Werner Baumann. He said he preferred an outside candidate as Baumann's successor. Also, a split of the group is not mandatory but is quite conceivable. According to Reuters2 , Ubben has contacted shareholders, investors and other stakeholders of Bayer AG, apparently in an effort to gain support for substantial changes. Inclusive Capital Partners holds a 0.83% stake in Bayer.

This same CEO, Werner Baumann, initiated the acquisition of Monsanto in 2016. Since then, the stock has been reeling under the pressure of damage claims well below the former 100-euro mark. The agricultural division casts a bad light on the entire group, as Monsanto pesticides harm pests and affect humans and possibly bees.

Following the EUR 58 billion deal with Monsanto, which went through despite shareholder opposition, Bayer's stock has yet to recover from the costly acquisition. In April 2015, the share price rose to EUR 133.42. Lawsuits against Monsanto's Roundup weedkiller, which allegedly causes cancer, have since resulted in billions in legal costs. Bayer maintains that its product is safe.

Baumann and his team lost a key vote of confidence at the Company's annual shareholder meeting in 2019. Although the result was not binding, it symbolized management's rejection. Despite the investors' revolt, the supervisory board extended Baumann's contract in 2020 until 2024.

Ubben believes the stock market is not sufficiently noticing the sustainable attributes of Bayer's Crop Science division. Bayer's investments in technologies such as genetically modified seeds could be integrated into global sales. This could reduce CO₂ emissions in agriculture, he points out.

With his former investment firm ValueAct, Ubben invested in Rolls-Royce in 2015, becoming the Company's largest shareholder. A year after that, the fund was granted a seat on the board after promising not to publicly advocate for a breakup of the Company or increase its stake.

With a 1.8 billion stake in Microsoft, Mason Morfit, president of ValueAct, succeeded in becoming a member of the board. A pattern of ValueAct and its successor Inclusive Capital Partners, is evident.

"Today, I am very pleased to announce that I will be joining Team Bayer as CEO." Bill Anderson (56) announced on February 8 on his LinkedIn 3 profile. #TeamBayer

"In my career, I have focused on two important things: First, working on innovations that improve lives, and second, creating workplaces and teams that are fulfilling, productive and give people the opportunity to make a lasting, positive impact," muses Anderson.

"It is a company with a globally recognized brand, a clear focus on life sciences, an inspiring vision, compelling goals and values, and a belief that innovation is key to addressing the biggest challenges facing people and our planet," he explains in his post.

As soon as April 1 4 , the US native will start at Bayer's headquarters in Leverkusen, Germany. Baumann will handle the transition until June when Anderson will take the helm completely. Almost a year before his contract expires, Baumann (60) thus begins his retirement. In retrospect, he has led the Group for four of the five years of his contract, despite the investors' vote of no confidence.

Clear the way for Bill Anderson. The engineer holds a Bachelor of Science in chemical engineering from the University of Texas and a Master of Science in chemical engineering and management from the Massachusetts Institute of Technology (MIT). The father of three previously headed the pharmaceuticals division of the Swiss Roche Group.

Anderson, 56, has held a number of other senior positions in the life sciences industry over the past 25 years. Among them, Anderson was CEO of Genentech, one of the pioneering companies in the biotech field. Prior to that, Anderson progressed through various leadership positions in general management, product design and finance at Biogen, a pioneer in the biotech industry, and at Raychem, a US technology and electronics company.

During his tenures at Biogen, Genentech and Roche, he participated in the development and launch of 25 new drugs, including 15 blockbusters. In addition to the United States, Bill Anderson has lived and worked in several European countries, including the United Kingdom, the Netherlands, Belgium and Switzerland. Now comes the architectural highlight with Germany's Leverkusen on the Rhine.

It is uncertain whether Bayer AG's agricultural division will remain under Bill Anderson's leadership in the future. Investment experts, brokers and influential shareholders 5 have long been pushing for the German conglomerate to be split up, as the two main divisions, Pharmaceuticals and Crop Science, have little use for each other. Consumer Health, on the other hand, fits in with Pharma.

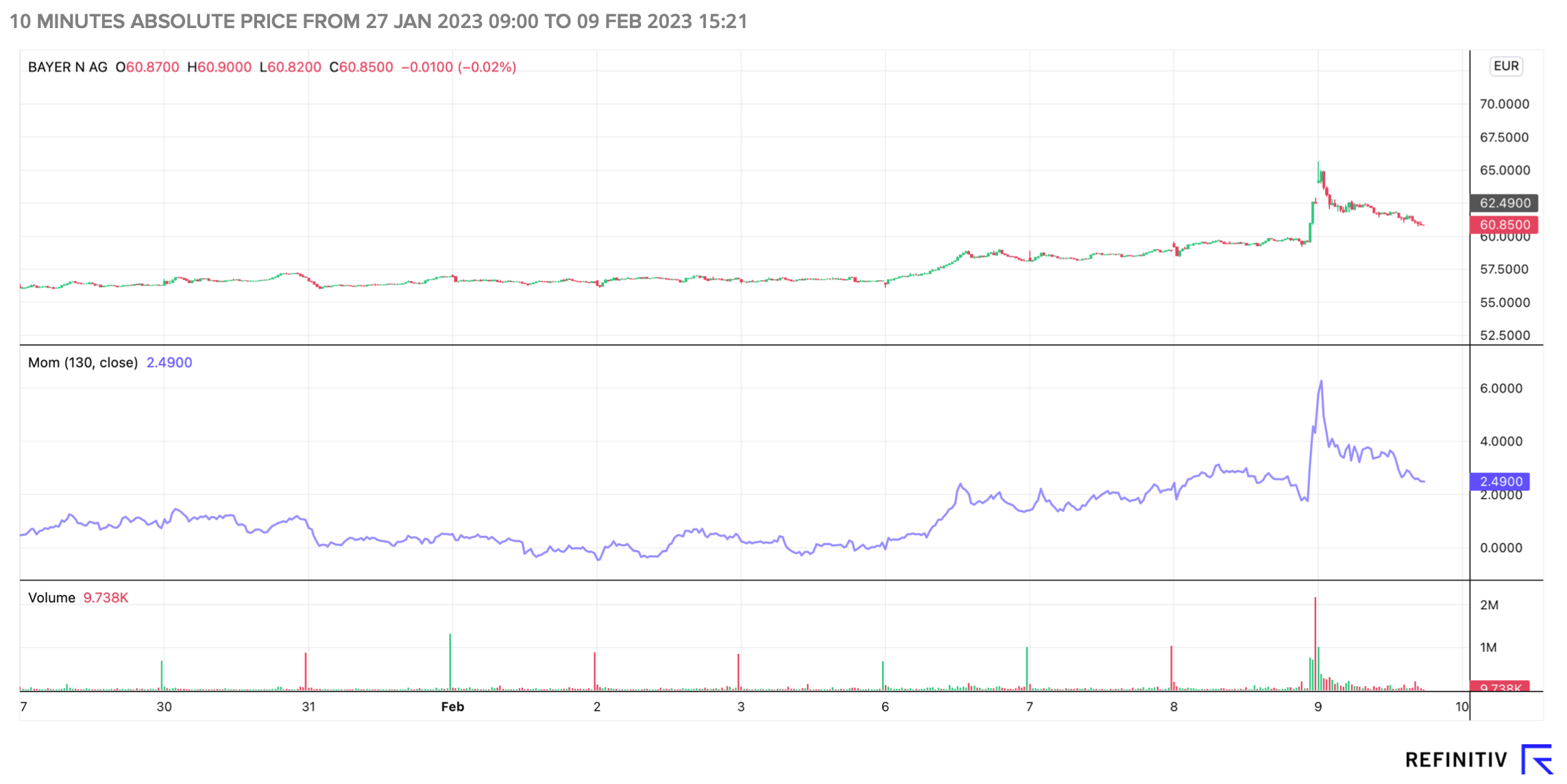

Since the beginning of the year, Bayer shares have risen 30%. On Thursday, Bayer shares shot up 5%, hitting an eight-month high since the leadership change news. Anderson's election by the supervisory board was unanimous. "He is the ideal candidate to lead Bayer into a new, successful chapter together with the team," said Supervisory Board Chairman Norbert Winkeljohann. Bill Anderson is the second manager in Bayer's history not to be recruited from within the Leverkusen company's own ranks.

The update is based on the initial Report 04/22