Collaboration with biotech promoter CQDM is like an accolade

The past Saturday marked World Cancer Day, aimed at raising awareness of the suffering of those affected by cancer and promoting new efforts against cancer. Canadian biotech company Defence Therapeutics is considered a hidden gem in the biotech universe due to its flexible platform approach and upcoming Phase 1 trial against cancer: The Company plans to enter clinical trials in the coming months with several projects at once, all of which are based on Defence Therapeutics' patented Accum™ drug enhancer. Among them therapeutic vaccines against cancer. The Company recently launched a new vaccine platform in collaboration with the University of Montréal and the Lady Davis Institute at the Jewish General Hospital.

Defence Therapeutics benefits from the collaboration on several levels. First, the joint project receives a grant of just over CAD 600,000 from the Montréal Region's Ministry of Economy, Innovation and Energy. Second, the funding and collaboration with a reputable research institution is a boost to Defence Therapeutic's product pipeline. And third, the insights from all involved researchers ultimately benefit the Company's progress.

The new project was initiated in conjunction with the CQDM, a Canadian organization that is considered a catalyst for biotech projects and in addition to government organizations, is sponsored by leading pharmaceutical companies including Pfizer, Merck, GlaxoSmithKline, Roche, Boehringer Ingelheim, Janssen, Eli Lilly Canada, Novartis Pharma Canada, Servier, Sanofi Canada, Takeda, AstraZeneca and Amgen. The CQDM has extensive oversight committees and a scientific advisory board, and in the past, has advanced promising projects in collaboration with various biotechs.

"CQDM is pleased to contribute to the efforts of the biotechnology company Defence Therapeutics," commented Véronique Dugas, Vice President of Scientific Affairs at CQDM. "With this project, we are promoting the development of a completely new vaccine approach that favours a more effective presentation of tumour antigens to immune effector cells," said the microbiologist and immunologist. "This project is an innovative immunotherapy strategy that potentially can be used to treat a broad spectrum of cancers and could improve the lives of many patients," Dugas said.

Chemotherapy via nasal spray? Studies around AccuTOX give hope

Defence Therapeutics is confident that the collaboration now launched will validate the efficacy and flexibility of Accum™ as a therapeutic option in the fight against cancer while also developing new vaccine strategies. "This project is a major step forward in our fight against cancer and could significantly change the field of cellular vaccination by targeting other tumour types in the future," said Prof. Moutih Rafei, VP Research & Development and Director at Defence Therapeutics.

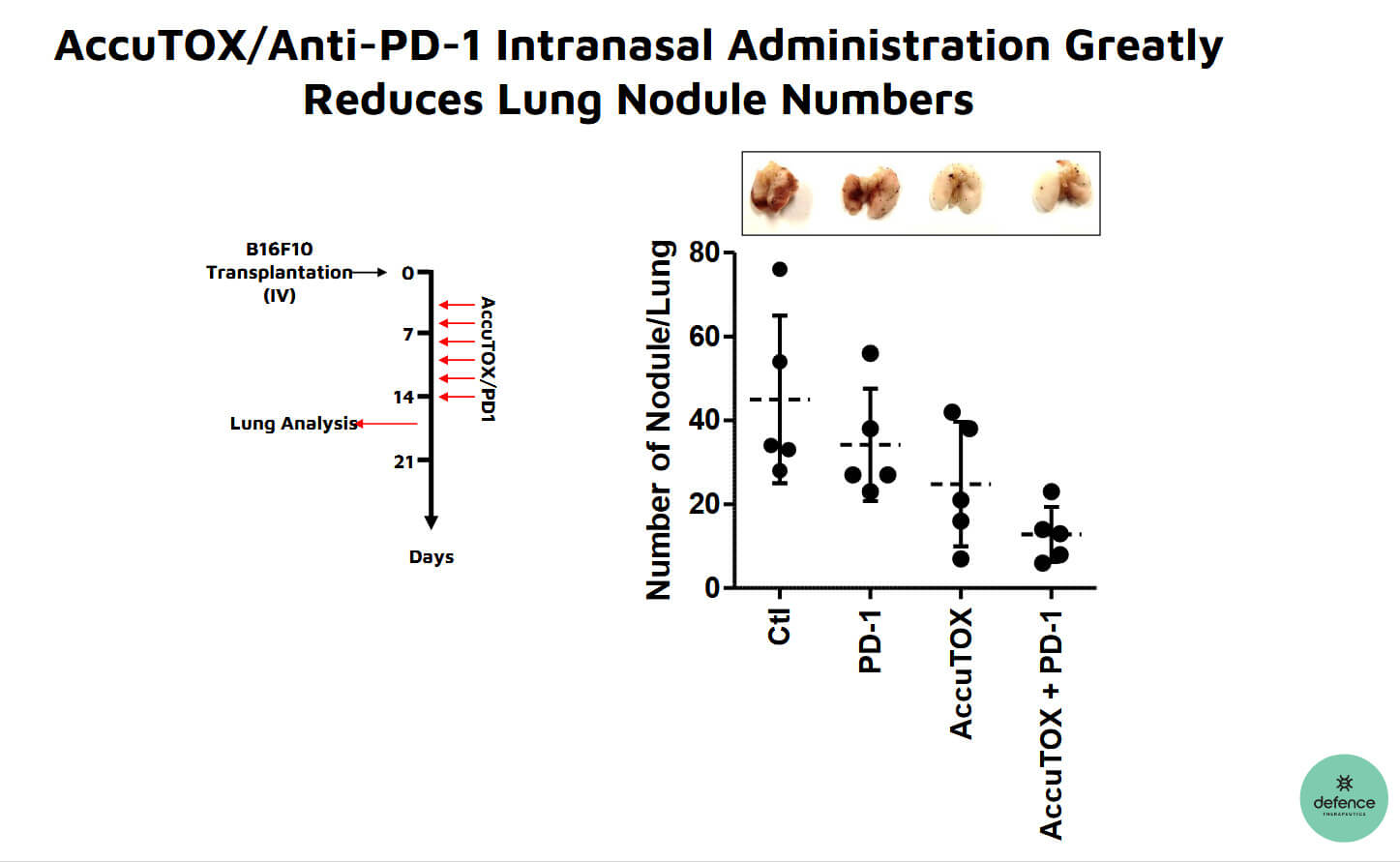

That Defence Therapeutics is a company that provides steady newsflow due to its numerous synergistic projects was further underscored last week when the Company reported progress in its GLP studies around the intranasal use of AccuTOX™ for the treatment of lung cancer. AccuTOX™ is a potentized version of the drug enhancer Accum™. Studies have shown that AccuTOX™ can induce premature cell death in tumour cells by damaging the cell in several ways. In addition to direct injection into the cell, Defence Therapeutics plans to investigate whether the substance cannot be administered as a nasal spray in the context of lung cancer. GLP studies are used to prepare for phase 1 trials.

Dosing regimen reduces cancer nodules by 50%

To date, Defence Therapeutics has demonstrated that AccuTOX™ is well tolerated by mice at doses up to three mg/kg body weight, which is approximately one-sixth of the injection dose, and can be administered up to six times over a two-week period. Use of this dosing regimen in mice with lung cancer reduced the number of cancer nodules by over 50% when administered in combination with anti-PD1 immune checkpoint inhibitor. Further GLP studies are planned to test tolerability when a sprayer is used. Among other things, this will involve the bioavailability of the active ingredient and the risk of possible irritation to the skin and eyes. A Phase 1 trial is also scheduled to begin in the coming months around the use of AccuTOX™ as a chemotherapeutic agent against lung cancer.

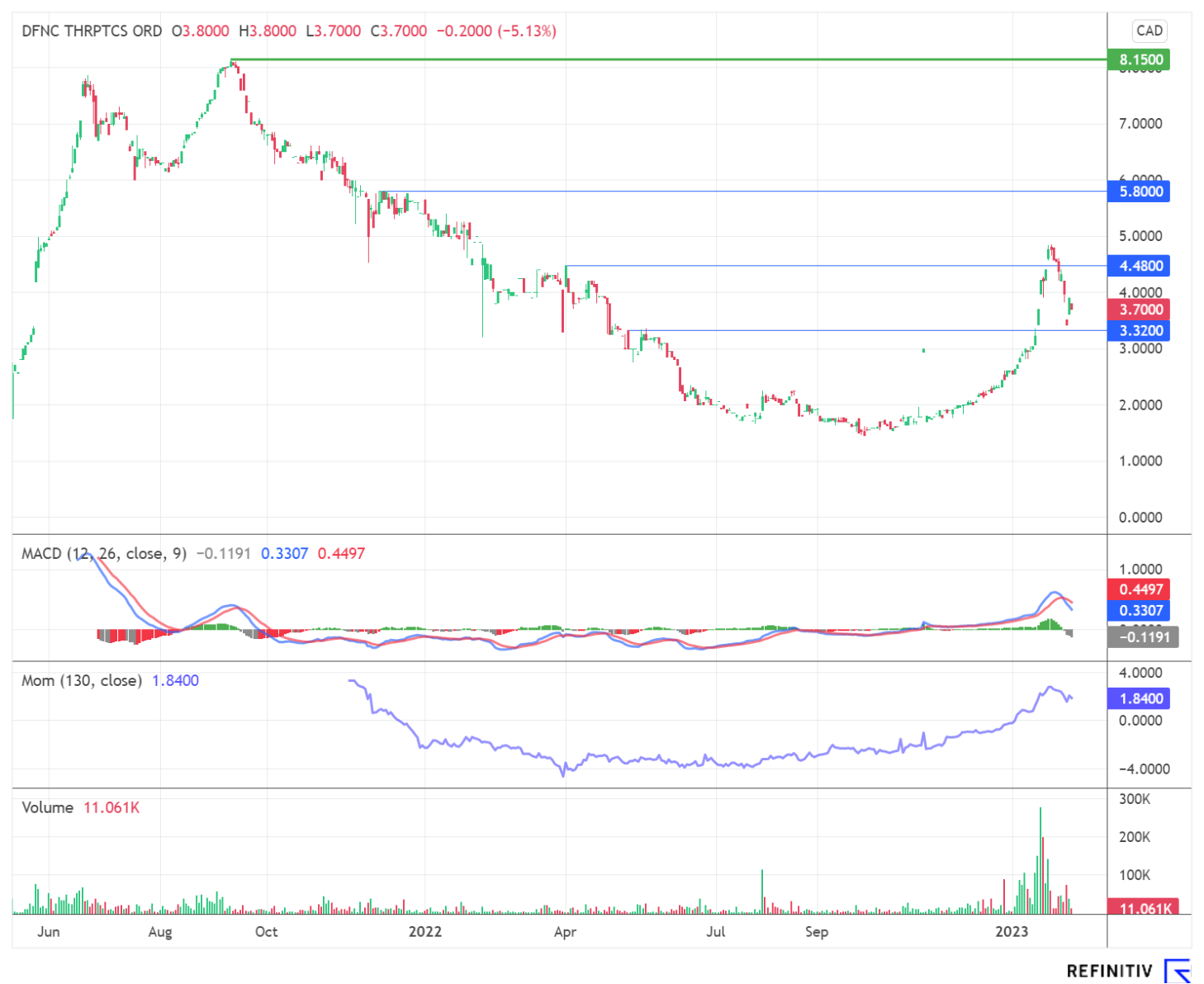

Analysts see biotech takeover wave - Defence fits the bill

In addition to the activities mentioned above, Defence Therapeutics is also planning to start a Phase 1 trial of a vaccine against the HP virus, which can cause cervical cancer, among other things. This extensive pipeline is due solely to the versatility of Accum™ as a drug booster. Similarly, in the recently announced collaboration between Defence Therapeutics, the University of Montréal and the Lady Davis Institute at the Jewish General Hospital, all parties emphasized the versatility of Accum™ and its potential. Word of Defence Therapeutics' broad spectrum has long since spread to investor circles. The share price was bullish for much of January and recently entered a consolidation phase. The stock's now ample liquidity could persuade more and more professional investors to get involved. After all, speculative investments need to be flexibly tradable from the perspective of market professionals in order to qualify for purchases.

could become targets of cash offerings in 2023, according to Canaccord Genuity.

It is possible that the growing number of professional investors within the Defense Therapeutics investor base is also responding to the current wave of biotech sector takeover activity. Recently, several analysts and market observers have announced their positive view on the takeover activity in the sector. Consultants at EY believe the sector is currently on the verge of normalization after a weak 2022. Analysts at Canaccord Genuity, in the person of John Newman, go further: "We continue to expect a biotech bull market in 2023, which could evolve into an acquisition wave as credit conditions improve," Newman told North American media. The analyst expects that, in particular, smaller acquisitions against bids with a size of between USD 1 billion and USD 10 billion could increase. Many prominent players in the industry would offload less promising areas and instead focus on technologies that promise returns in the medium term - such as the Defence Therapeutics portfolio, which could develop even greater potential under the control of large and well-capitalized pharmaceutical and biotech groups.

Investor conferences could boost shares

Trade meetings and conferences traditionally play a significant role in the initiation of deals. In January, pharmaceutical companies AstraZeneca, Ipsen and Chiesi each completed billion-dollar deals during a JP Morgan healthcare conference in San Francisco. On February 7, another conference will begin in New York, the Immuno-Oncology 360°, which aims to bring together representatives from business and the biotech industry with a focus on cancer. Defence Therapeutics will be present with a booth and will contribute to the success of the event with two presentations around its own technology. It would not be surprising if the Company, which is currently valued at just over EUR 100 million, attracts the attention of additional investors during the event. Then on February 15, interested parties are invited to attend a free presentation by Defence Research Director Prof. Moutih Rafei at the 6th International Investment Forum (IIF). These events are bound to be good for spreading the investment story around Defence Therapeutics.

Interim conclusion: The experts are convinced - investor conferences are imminent

The new collaboration of Defence Therapeutics under the leadership of the Canadian biotech catalyst CQDM, whose advisory boards include numerous experts and which is supported by leading pharmaceutical multinationals, among others, underscores how seriously experts are already taking the research portfolio of Defence Therapeutics. Experts from Europe, such as pharmacologists and immunologists, are also showing recognition in light of Defence Therapeutics' recent corporate news and see great prospects in the Company.

As expected, the volatility of the share increased during the past trading days. Some short-sellers likely made their profits with the share during several intraday corrections. After the cleansing storms, the stock is still trading below its recent highs. With new investor groups providing support, the stock could regain momentum and put pressure on short-sellers. The associated risk of increased volatility is offset by the opportunity for a complete re-rating of the stock. Defence Therapeutics, with its platform profile around mRNA and immuno-oncology, fits the mould of the wave of acquisitions expected by industry insiders around smaller biotechs. That should become clear to even more investors in light of upcoming events. Measured against historical takeover premiums, the Company still appears to be moderately valued at around EUR 100 million.

The update is based on the initial report 12/2021