What makes good mRNA vaccines

Sébastien Plouffe, CEO of Defence Therapeutics, firmly believes that Accum™ makes the mRNA vaccine even more effective. The background is the way Accum™ works. Like a kind of solution, the drug enhancer takes in different vaccines or even drugs and helps them overcome biochemical hurdles in cells. In the case of mRNA vaccines, more mRNA information enters cells via endocytosis, where it can be read by ribosomes. This is a prerequisite for antigens to be generated according to the mRNA blueprint and presented on the cell surface, which ultimately triggers the immune response of the body.

The importance of ensuring that this process is not compromised is demonstrated by the first commercial application of an mRNA vaccine. When the pandemic was declared in 2020, numerous pharmaceutical companies and biotechs set out to develop an mRNA vaccine. In Germany, the race between BioNTech and CureVac in particular, caused a stir. While BioNTech reported high efficacy rates well beyond the 90% mark with its vaccines against COVID-19, CureVac's laggards failed and fell short of expectations with efficacy rates below 50%. What was the cause of the disparity in results, even though both companies were betting on mRNA technology?

mRNA role model BioNTech

BioNTech, unlike CureVac, has chemically modified its mRNA. This so-called modRNA involves the use of synthetically modified nucleosides. In BioNTech's case, this is pseudouridine, while CureVac relied on uridine. Both substances are almost identical; in the case of pseudouridine, only a few atoms in the molecule of the base are arranged differently. This small difference protects the mRNA from ribonuclease degradation and prevents the immune system from killing the vaccine too early. Nevertheless, even with vaccines containing modRNA, the subsequent immune response is large enough to eliminate the need for drug boosters, so-called adjuvants, such as aluminum salts. While CureVAC wanted to induce the strongest possible immune response in the body by using "pure" mRNA and ultimately failed precisely because of the complex process, the chemical modification of the mRNA using pseudouridine proved to be the key to success for BioNTech.

So what does this example mean for the evaluation of mRNA projects from an investor's perspective? The different results of BioNTech and CureVac show that in mRNA technology, it is crucial how a corresponding vaccine is taken up and processed by cells. The fact that the use of pseudouridine, i.e. modRNA, is the key to success is now common sense among experts. But it is at least as much a truism that biochemical processes are complex and that cells do not function like computers that ultimately spit out either zeros or ones.

Researchers: Any means necessary to make mRNA vaccines more effective

For this reason, too, it makes sense in the development of mRNA vaccines to take advantage of every available option to increase efficiency. Especially because mRNA is not only a key technology in the fight against infectious diseases but will also play a crucial role in curing cancer, innovative adjuvant technologies such as Accum™ are urgently needed - experts, such as Prof. Niels Halama of the German Cancer Research Center (DKFZ) in Heidelberg see "huge potential" in mRNA technology, as the scientist explains on the DKFZ website. Especially in cancer, mRNA vaccines could fully exploit their potential since developing individual therapies for respective tumors in cancer is essential. With mRNA vaccines in particular, this customization is a matter of weeks instead of years or months, Halama said. Asked about the efficacy of mRNA vaccines against cancer, the professor expressed confidence but stressed that the effectiveness of mRNA vaccines can vary from patient to patient due to different starting points. Also, he says it is important that an immune system be capable of fighting a tumor in the first place.

These remaining hurdles, which researchers want to see illuminated only in clinical trials, argue for taking every measure possible to increase the effectiveness of mRNA vaccines. In addition to the approach of chemically altering mRNA, as BioNTech has implemented with Comirnaty, there is a strong case for using other adjuvant technologies, such as Accum™, according to pharmacologists. Although Defence Therapeutics is yet to conduct corresponding clinical trials, initial results can be expected soon - the combination of a specially produced mRNA vaccine with Accum™ has already been successful. All that is missing now is the comparative study with "naked" mRNA. If one asks pharmacologists about the possibility of combining Accum™ with existing approaches, such as modRNA, they see no technical obstacles to combining the two approaches - subject to pending clinical trials.

US government raises USD 5 billion for mRNA technology with "NextGEN"

The fact that it is vital to improving vaccine technology is also shown by the US government's recently launched funding programme for vaccine technology. The project "NextGEN" was first announced by the White House and provides funding of USD 5 billion to actively counter future coronaviruses and other threats with new technology.

the USA wants to invest in mRNA innovations

Specifically, it involves collaborations between the US and private companies to promote new technology to prevent harm to the US and its citizens. Concerning COVID-19, while a US health system representative points to the continued effectiveness of existing COVID-19 vaccines to Reuters, he sees potential dangers: "New variants and loss of immunity over time could continue to challenge our health systems in the years ahead." The fact that existing vaccines do not effectively prevent infections is another reason for the NextGEN project.

The US initiative shows that the development of mRNA vaccines is only just beginning. Any technology that can ultimately increase the efficacy of mRNA vaccines - whether against COVID-19 or cancer - must therefore be seen as potentially promising. Defence Therapeutics is also confident in "NextGEN": "Accum™ could definitely be a technology to be promoted under the recent US initiative," says CEO Sébastien Plouffe.

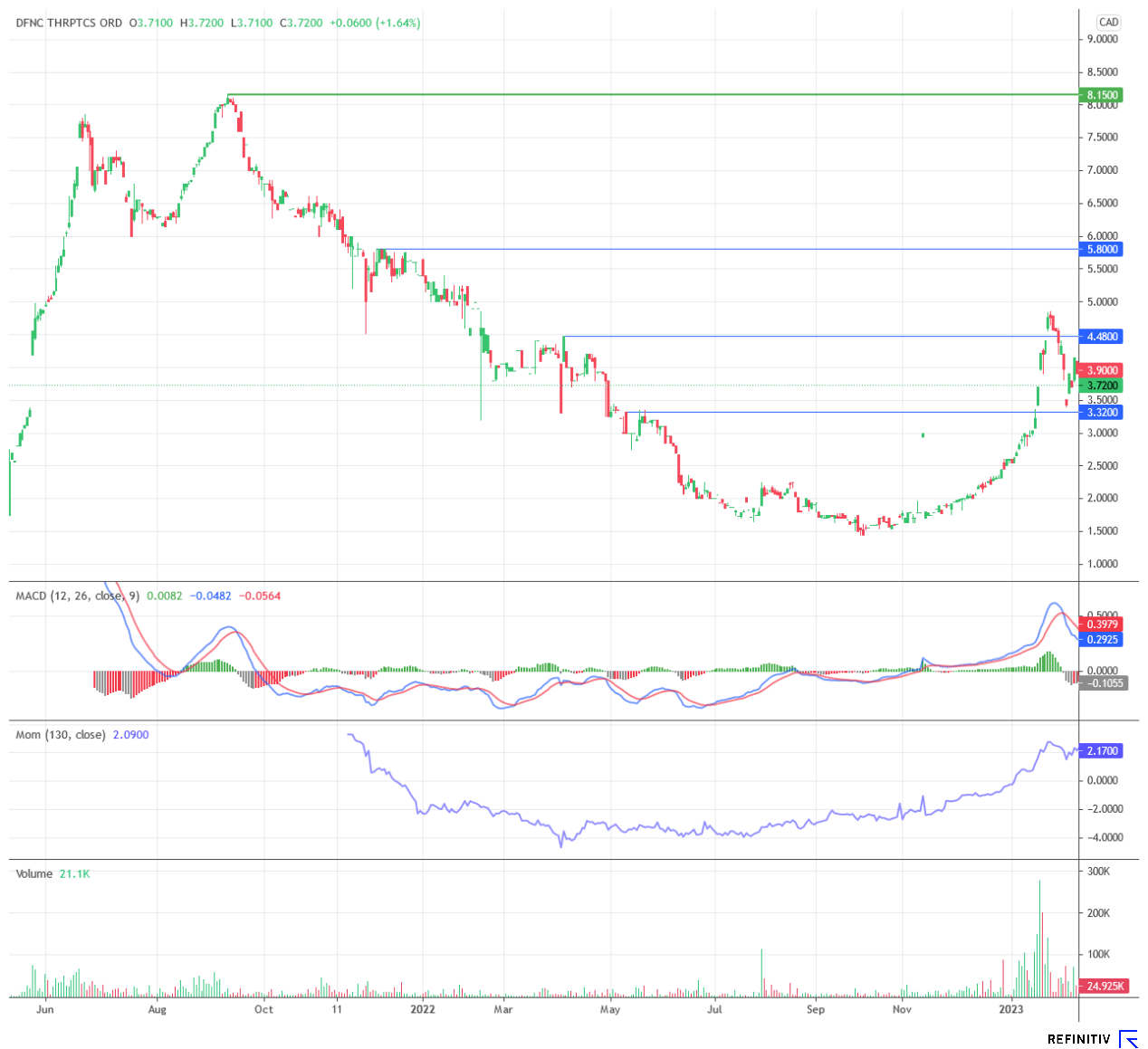

Chart of Defence Therapeutics: Technically promising

The Defence Therapeutics share accurately reflects the market sentiment over the long term: In 2021, as a hope against cancer, the value reached prices beyond the CAD 8 mark. In 2022, like many other biotechs, the share lost considerable value. Above all, the unclear financing situation weighed on the entire sector. In 2023, however, Defence Therapeutics, in particular, swam free. After a dynamic upward movement, the share has now consolidated. Beyond CAD 4, the value could develop new momentum.

Conclusion: Wide range of applications beyond the mRNA trend topic

The upcoming trial pitting Defence Therapeutics' "naked" mRNA vaccine against the combination of mRNA vaccine and Accum™ could provide key insights for the Company. All studies indicate that Accum™ different compositions of biologically active substances can help overcome biochemical hurdles within cells, increasing the effectiveness and safety of active substances. Particularly in view of possible new infectious diseases, but also mRNA cancer therapy, which experts believe will require individualized approaches, biotech companies are likely to leave no stone unturned to increase the effectiveness of their active ingredients.

The market potential around mRNA solutions

Accum™ could, therefore, not only help Defence Therapeutics' various vaccine projects (including skin and breast cancer) but could also be licensed to numerous other companies due to its great flexibility. Since Defence Therapeutics is not only pushing ahead with promising projects around mRNA technology, but Accum™ in potentized form as AccuTOX™ is also to enter a clinical trial as a chemotherapeutic or can be used as radionuclide-antibody conjugate together with the French state-owned company Orano, investors in Defence Therapeutics are betting on several promising projects at once. The Canadian company has gone from strength to strength in the past few months. Further announcements are likely in the coming weeks.

Share could pick up speed after consolidation

Most recently, the share was admitted to the CSE25 Index. This should not be the last promotion for the stock. In the medium term, the shares of the biotech innovator are expected to go to the Nasdaq. Further attention will then certainly be paid to the Company and the share. After consolidation, the biotech stock also appears promising for investors - the "deep-dive" into the history of the young mRNA technology shows: Defence Therapeutics' projects make sense and could soon make the Company a sought-after partner of large biotech and pharma companies. The associated market, given the flexibility of Accum™, is enormous and is likely to exceed the more than USD 128 billion expected by market researchers at Precedence Research for mRNA solutions by 2030.

The update is based on the initial report 12/2021.