Two-stage test to prove the potential of Accum™

According to Defence Therapeutics, the test will proceed in two stages. In the first stage, mice are injected once with and once without Accum™ mRNA, which contains the blueprint for exogenous ovalbumin.

the mRNA market is expected to grow by 2030, reaching approximately USD 128 billion, according to Precedence Research.

Blood is then drawn from the mice every two weeks over a six-week period, and the concentration of antibodies is measured. According to Defence Therapeutics' hypothesis, mice that received a combination of mRNA and Accum™ should have a higher concentration of antibody titers, as the mRNA blueprint should be better-implemented thanks to Accum™.

In a second study, the Company puts a focus on antineoplastic efficacy. This refers to symptom relief and life extension, particularly in cancer treatment. To this end, solid T-cell lymphomas are transplanted into mice with ovalbumin on their surface. The animals then receive a prime-boost injection of the Accum™ mRNA vaccine, and tumor growth is analyzed in more detail. Results from the first in vivo study could be available by the end of May according to the study plan. This will be followed by testing in mice with solid tumors. For this phase, the longer Defence Therapeutics does not report results, the better - as the mice are still alive and the study is not yet completed.

Trend-setting results in as little as six weeks?

"These in vivo tests are very important for our strategic growth, as they will show how Accum™ technology can be adapted to synergize with mRNA vaccines," says Sébastien Plouffe, CEO of Defence Therapeutics, confidently. When pharmacologists are asked about the study design that has now been communicated, the plans of the Company also sound plausible to independent experts. If the vaccination works in Phase II of the study currently underway, immune cells will produce an appropriate number of antibodies against the ovalbumin. These antibodies dock onto the ovalbumin on the tumor cells and mark it for killer cells.

If the study is successful, Accum™ would finally rise to the status of an in-demand adjuvant technology for mRNA vaccines and could both advance Defence Therapeutics' own planned vaccines and spur projects by other companies. By its own account, Defence Therapeutics is advancing both plans in parallel. In an overview of all Defence Therapeutics' projects published at the end of February, the mRNA approach still ranked in the development stage. Significantly further along are the two projects, ARM and AccuTOX™. The former is a cell vaccine against established tumors, the latter a chemotherapeutic agent to be administered against skin, breast or lung cancer, depending on the stage. Both projects are expected to move into Phase I trials before the end of 2023. Around AccuTOX™, Defence Therapeutics has already won the prestigious "City of Hope" hospital in the Los Angeles area to correctly submit all applications to the US Food and Drug Administration (FDA).

Other advanced projects against cancer continue in parallel

Defence Therapeutics' other projects include a protein vaccine for cervical cancer and a therapy for breast cancer using the antibody-drug conjugate AccuADC-001. Defence Therapeutics has already demonstrated that redesigning known ADCs for breast cancer with Accum™ components can improve efficacy of commercially available ADCs by more than 100-fold.

Defence Therapeutics remains valued in the low triple-digit millions.

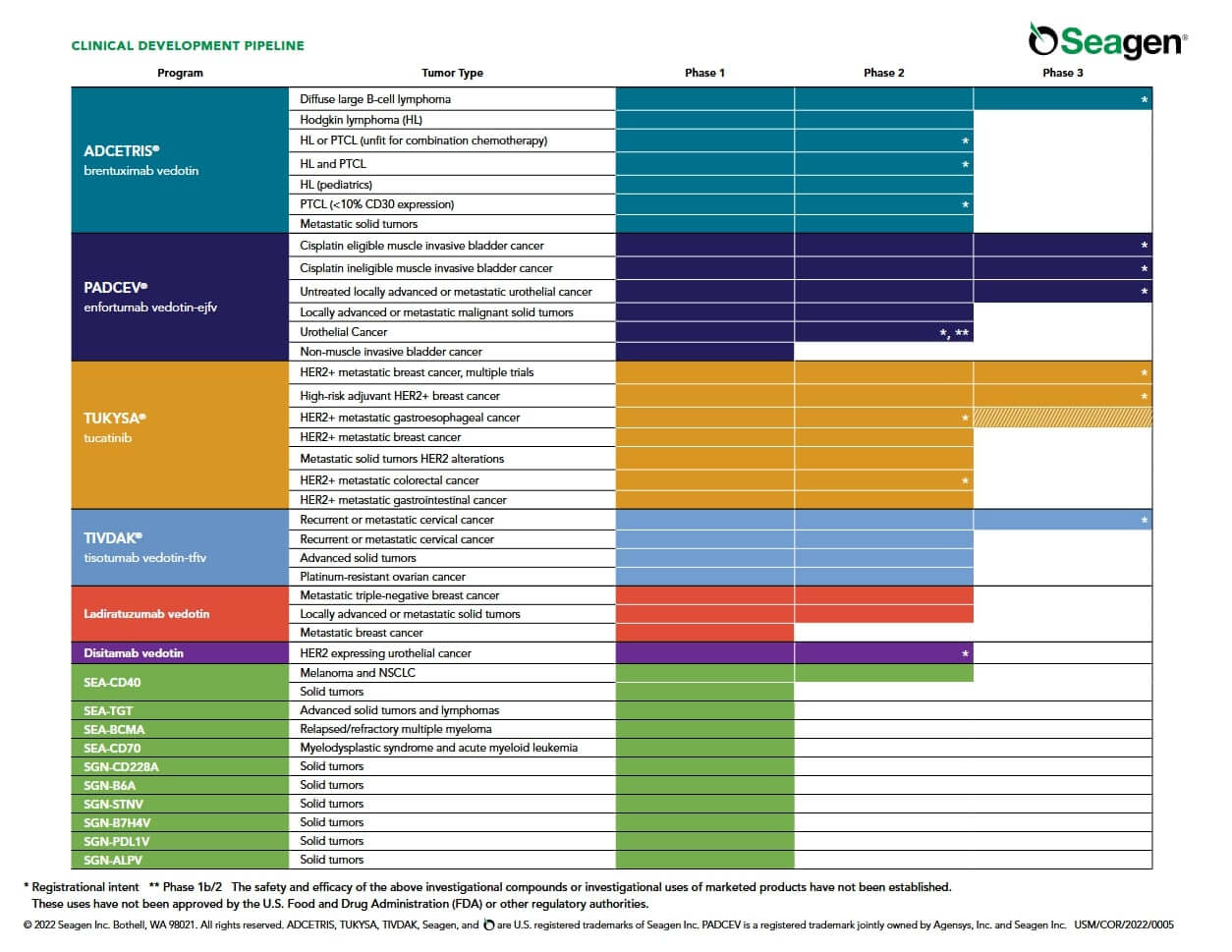

The fact that Defence Therapeutics now also wants to show how versatile its own Accum™ technology is with its mRNA projects comes at the right time for existing investors. Already for months, pharmaceutical companies and large biotechs have been pouncing on innovative technologies. In January, AstraZeneca, among others, bought innovative technology. Most recently, Pfizer followed suit and bought Seagen, a biotech which, like Defence Therapeutics, has set itself the goal of defeating cancer through antibody-drug conjugates. The purchase price for Seagen is USD 43 billion - Defence Therapeutics' market cap remains in the low triple digits despite recent progress.

Interim conclusion: Defence meets the spirit of the times with Accum™

Defence Therapeutics could announce as early as the end of May that its patented Accum™ technology can also jump-start mRNA vaccines. In parallel, there are other projects, even more advanced, that are expected to move into regulatory trials as part of Phase I studies in 2023, all of which are based on the patented Accum™ technology. It stands to reason that Defence Therapeutics will succeed in establishing further high-profile partnerships following the nuclear medicine collaboration with Orano. These could entail royalty payments or ultimately result in a takeover of Defence Therapeutics. After numerous big names, such as AstraZeneca and Pfizer, have recently put out their feelers for biotech companies and even tech great Elon Musk has joined the discussion, the topic remains hot. Technically too, the share appears promising after the consolidation of the past weeks.

The update is based on the initial report 12/2021