BioNxt: "Establishing commercial production is a priority in 2023"

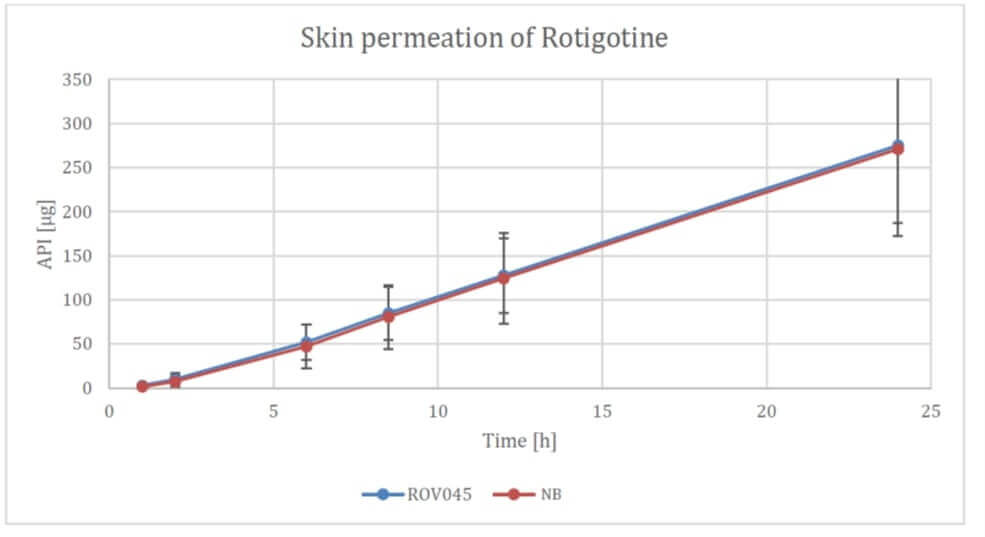

At the beginning of the week, the Company made another big move: BioNxt has acquired modern coating and cutting equipment and intends to expand the commercial production capacities of its German subsidiary, Vektor Pharma TF GmbH, accordingly. The facility will produce both the orally dissolvable formulations, such as the enteric-coated tablets, and the transdermal formulations, such as the rotigotine patches, which have already achieved excellent results in comparative studies with established products. Rotigotine is an active ingredient for Parkinson's disease and is administered through patches. The active ingredient must be continuously delivered to the skin. According to Wissen Market Research, global total sales of rotigotine patches in 2021 amounted to USD 518 million. By 2030, analysts expect sales to increase to USD 760 million. At its Vektor Pharma TF GmbH site in Biberach County, BioNxt has been producing biosensors, such as test kits for detecting inflammatory diseases of the oral cavity.

"Building BioNxt's commercial production is a priority for 2023, and with the ongoing commercialization of BioNxt products and potential contract development and manufacturing opportunities, the Company is committed to rapidly achieving its commercial capacity," said Hugh Rogers, CEO and director of BioNxt. "We are planning a strategic and versatile production line for study materials and commercial end products, both transdermal and orally disintegrating."

New technology drives growth in dosage form market

According to market researchers Precedence Research, the drug delivery market volume was USD 1,525 billion in 2022 and is expected to grow to USD 2,047 billion by 2030. That represents a growth rate of 3.7% p.a. Particularly against the backdrop of growing cost pressure in the healthcare sector, innovative dosage forms of medicines are playing an increasingly important role.

will lie dormant on the market for drug delivery forms by 2030

The more effectively drugs can be administered, the cheaper they are to produce. This makes it possible to position successful generics on the market or to bring new active ingredients to market in the best possible way. The market researchers at Precedence Research see the market for the administration of drugs as promising, particularly because of the growing number of chronic diseases. According to the analysts, growth is also driven by the increasing use of new technologies, whether in the form of innovative dosage forms or thanks to modern processing facilities. The production line for tablets to be used by Vektor Pharma in the future is a German product of the latest standard, operates fully automatically and offers sensor-controlled layer thickness measurement. The cutting machine acquired also operates fully automatically and offers a camera-based laser cutter and a pick-and-place robot. Machines of this type, such as those manufactured by the German company KUKA, can perform countless operations per minute with the highest precision.

The diagnostics business field also has prospects

The latest investments in production capacity at the German site underscore that BioNxt is well on the way to commercializing its projects. Last October, the Canadian biotech made a breakthrough around its active ingredient patches for rotigotine. It announced its intention to transfer the technology in an in vivo study, which could lead to market maturity of its rotigotine patches within six to twelve months. Meanwhile, BioNxt is at a similar stage with its enteric-coated tablets. Here, the first pilot studies are imminent.

the market for oral health could be worth by 2028

Already in use today are biosensors from BioNxt, which are also manufactured by Vektor Pharma in Germany. These enable even laypeople to screen themselves for stomatitis, periodontitis and peri-implantitis. Last fall, BioNxt signed a non-binding letter of intent with a US company to collaborate on thin-film screening tests. Specifically, it could be to produce oral health tests for the US market. According to estimates, between 6.7 and 7.6 million people were dependent on opioids in 2019 alone. Buprenorphine is often used to treat the use disorder. That, in turn, favors oral inflammatory disease as a side effect. Insurance companies will likely be interested in proactively countering costly treatments, including implants, through timely prophylaxis. According to Global Market Insights, the market for biosensors and oral health could reach USD 43.6 and USD 44.5 billion**, respectively, by 2028.

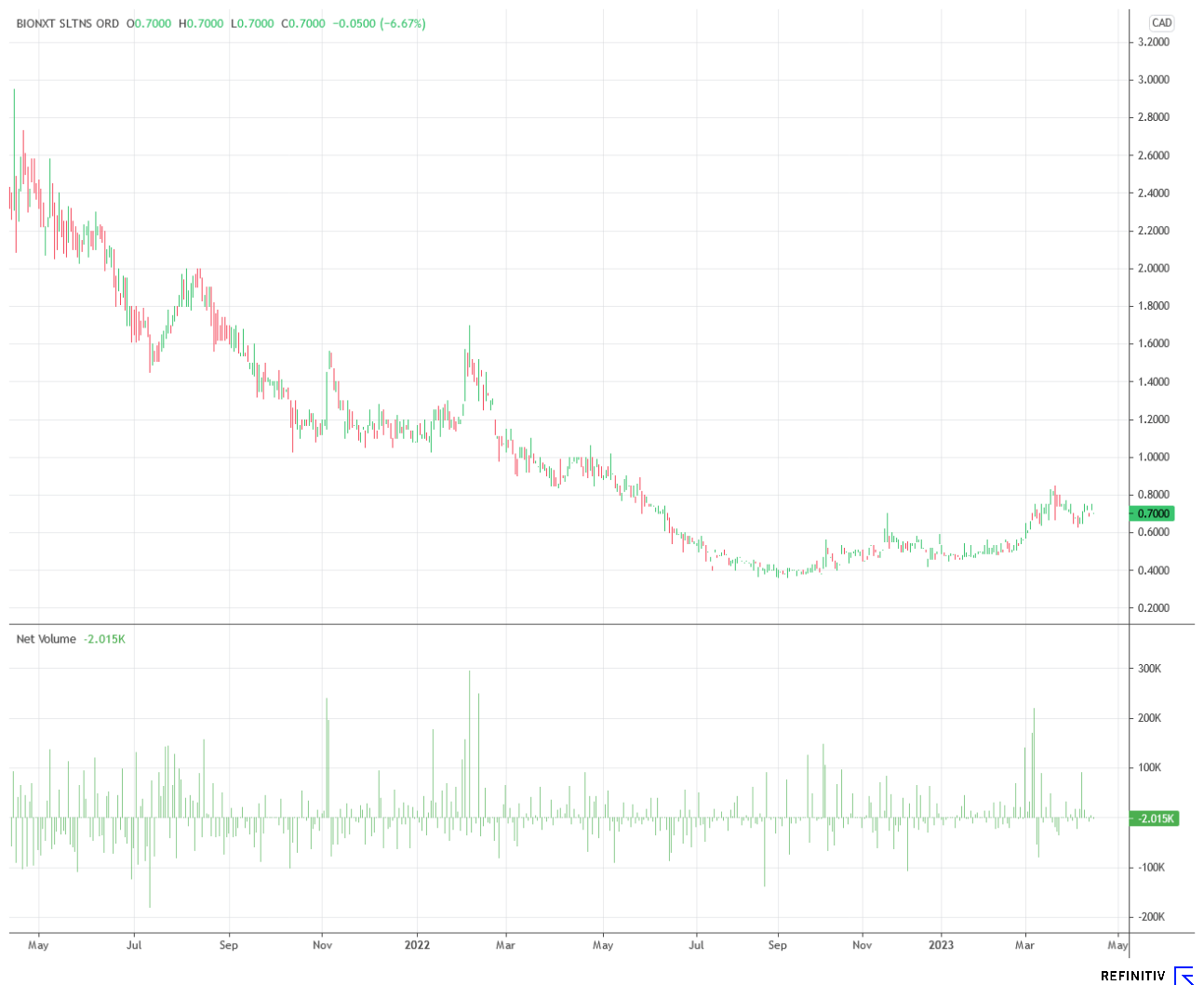

Chart picture: A comeback is in the air here

Looking at the share price performance over the past two years, a bottoming out has been evident since last summer. Since BioNxt Solutions is also making significant progress operationally, and the areas of biosensors and innovative drug delivery systems are expected to generate notable sales in the medium term, the share could be promising at the current level. The third business area, in which the Company is researching psychedelics, could also benefit from recent operational progress. The chart technical starting position is promising, especially in light of the expected newsflow.

Interim conclusion: many projects, newsflow ahead

BioNxt has already acquired a state-of-the-art manufacturing facility for active ingredient patches and tablets. The enteric-coated tablets are available as prototypes and are to be clinically tested as soon as possible. The Company's own active ingredient patches with the Parkinson's active ingredient rotigotine already performed successfully in pilot studies last fall. In view of the wealth of developments at BioNxt, the coming weeks should also be eventful. Investors can therefore expect a steady news flow. In addition to the just starting business with innovative dosage forms, which is booming especially against the backdrop of cost pressure in the healthcare sector, the business with biosensors also has great potential.. A non-binding letter of intent for cooperation with a pharmaceutical company in the US already exists - here, too, new developments could arise in the future.

The update is based on the initial report 02/2022