Institutional investors have high expectations of Bill Anderson. They hope that he will regain the trust of investors and thoroughly examine the Company's structure. After all, there has been speculation for years about a possible split that could at least partially address shareholder resentment. "For me, it is about, hey, we have three amazing businesses that deliver really important products and medicines," Anderson said. "I am going to focus on considering all of that, how we can drive progress, and what opportunities are out there."

The Company will hold its annual shareholder meeting on April 28. Quarterly figures from Q1 2023 will follow on May 11. Looking back, 2022, the year with the start of the Russian war of aggression in Ukraine, was sluggish. Bayer AG increased its sales by 9% to EUR 50.7 billion. EBITDA adjusted for special items rose 21% to EUR 13.5 billion. But on the stock market, Bayer, once the most valuable company in the DAX, is now worth only about as much as it paid for Monsanto.

Pharmaceuticals Division is slimming down

In the Pharma Division, Stefan Oelrich declared that he would not devote any further R&D to women's health. The Company emphasized that it would continue to focus on developing clinical-stage products. These include elinzanetant, which will be used to treat physical symptoms during menopause. Bayer Pharmaceuticals is confident that the treatment will generate peak sales of more than EUR 1 billion. A McKinsey study1 indicates that in 2020, only 1% of R&D investment outside of oncology was in women-specific diseases. A maximum of 4% of clinical-stage investments were dedicated to women-specific cancers. The Company instead focuses on four core therapeutic areas: Oncology, Cardiovascular, Neurology and Rare Diseases/Immunology.

In addition to elinzanetant, Bayer has two other promising compounds in the pipeline focused on treating endometriosis. This condition occurs when endometrial-like tissue grows outside the uterus.

- The first compound, BAY2328065, has already successfully completed three Phase I studies to evaluate its safety, tolerability and pharmacokinetics.

- The second compound, BAY2395840, is being tested for the treatment of diabetic nerve pain and has also passed three Phase I safety studies.

A fourth Phase I trial specifically targeting patients with diabetic neuropathic pain and renal dysfunction is pending, and enrolment is ongoing. Bayer is on the right track to improve the treatment of endometriosis and diabetic nerve pain and give hope to patients.

Crop Science: first digital trials and continued strength in crop protection

Last year, the agricultural division advanced 15 projects, including 9 new active ingredients in crop protection, 4 digital solutions and 2 plant traits. Around 500 new varieties were added to the seed portfolio in corn, soybeans, cotton and vegetables. In the crop protection business, Bayer Crop Science had 250 new product registrations last year.

Digital solutions include the FieldView digital platform2 . FieldView aims to help farmers manage their fields more efficiently and effectively by providing insights into farm performance and enabling farmers to make data-driven decisions. This is done, for example, through field mapping, yield analysis and weather monitoring.

A collaboration between Microsoft and Bayer Crop Science has been in place since 2019. The partnership aims to create another comprehensive digital agriculture platform that provides farmers with insights into every aspect of their operation: From sowing to harvesting to supply chain management. With this platform, farmers can optimize their operations, reduce waste and improve sustainability, leading to better outcomes for farmers and the environment. Results are scheduled to be presented at the New York Innovation Summit on June 1.3

Consumer Health benefits from Corona pandemic and increasing allergies

This division was characterized by high demand for dietary supplements and over-the-counter cold remedies. Not surprisingly, Covid had a global grip on people, causing flu-like symptoms that many cured at home. When all was fallow, the division took advantage of growth opportunities in the e-commerce business, where it increased sales from 4% to around 11%.

Sun protection and allergy remedies remain valuable product categories in consumer health worldwide. Bayer's Astepro, for example, is a nasal spray for treating the symptoms of seasonal and year-round allergic rhinitis in adults and children 12 years and older. The drug releases an antihistamine, thereby relieving allergic reactions. In allergic rhinitis, the body's immune system overreacts to allergens such as pollen, animal dander or dust mites. This leads to symptoms such as sneezing, itching, runny nose and congestion, which are unbearable for those affected. Since it can be sold over-the-counter without a prescription, Bayer is hoping for strong sales growth with it.

Multiboard member Winkeljohann is said to have pushed the search for a new CEO

Norbert Winkeljohann, chairman of the Board of Management, recently received the backing of two prominent shareholder advisory firms for his re-election on April 28. Despite criticism from two German investment groups that find fault with his numerous directorships, Winkeljohann appears to be well on his way to retaining his position.

The fact that leading experts in industry recommend him speaks volumes about his abilities and commitment to the Company. It remains to be seen how the situation will develop further. Winkeljohann and his team can be assured that they have the support of some key players in the shareholder landscape.**

In addition to his mandate at Bayer, Winkeljohann is Deputy Chairman of the Supervisory Board of Deutsche Bank. He also sits on the supervisory bodies4 of several medium-sized manufacturers: tire dealer Bohnenkamp, steel manufacturer Georgsmarienhütte and building materials specialist Sievert.

"We will vote against the re-election of Mr Winkeljohann", explains fund manager Janne Werning of Union Investment 5 , "the accumulation of offices is blatant." "The Supervisory Board chairmanship at Bayer is not a part-time job, comments Werning", "Bayer has major tasks ahead of it. It is a matter of reviewing the Group structure and restoring the damaged trust on the capital market." Winkeljohann assured in writing that he has so far fulfilled all his duties within the scope of his position at Bayer AG.

Interim conclusion

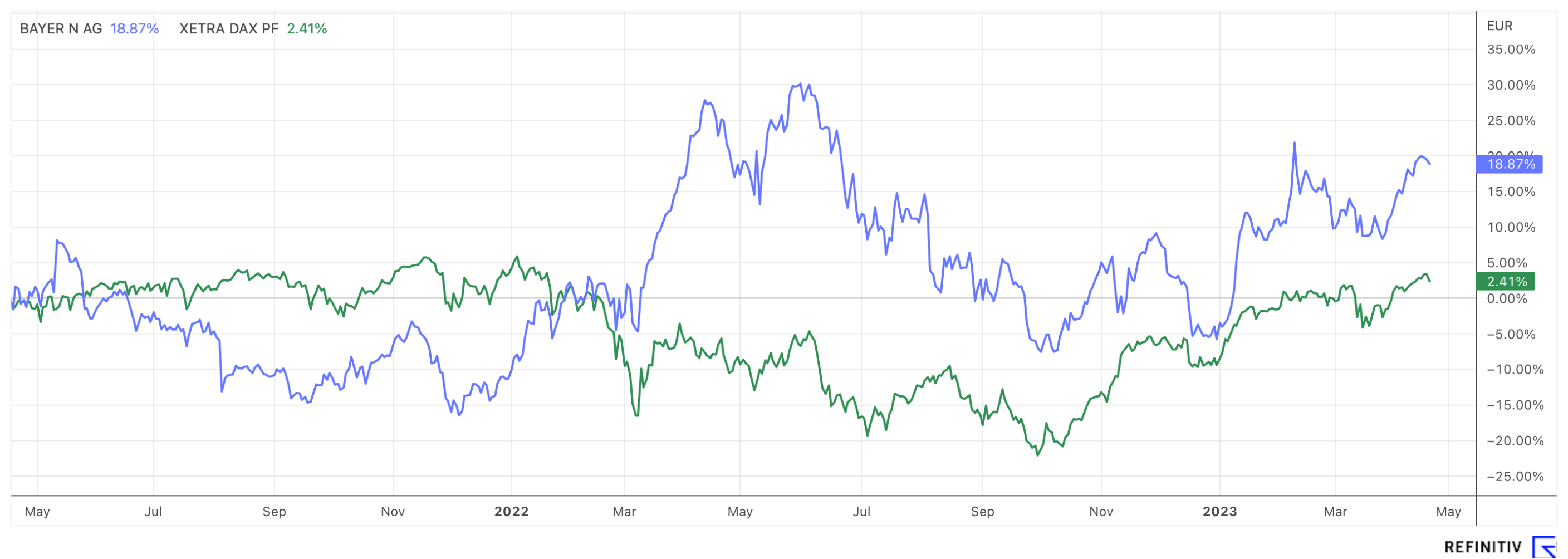

Analysts are largely positive about developments and are giving clear buy signals. Also, the Company's intrinsic value is far from being reached, according to an analysis by Refinitv. The annual general meeting will be held on April 28. The last one for Werner Baumann. And possibly the beginning of a new era for investors. The new CEO Bill Anderson is in for a major clean-up. Baumann leaves behind a whole sack full of lawsuits regarding the possible carcinogenicity of the weedkiller RoundUp in the Monsanto case. The pipeline in the Pharmaceuticals division rumbles along, and Oelrich resorts to drastic changes.

There is rumbling behind the scenes. In addition to the change in management, the power struggle of major investors to assert their voting rights according to their interests is bubbling. In contrast, the planned votes against the discharge of the Board of Management by environmental activist Marius Stelzmann seem almost like a storm in a teacup6

"Some of our members are critical stockholders, and we are now collecting voting rights to vote against the discharge of the Board of Management and the Supervisory Board on the relevant issues." For example, despite some 154,000 lawsuits filed so far by glyphosate victims in the US alone, Bayer AG has shown itself unwilling to remove the herbicide, classified by the World Health Organization as "probably carcinogenic," from the market. 7

One thing is striking and a well-known Leverkusen communication strategy: the more Bayer does something seemingly good, be it supporting charities or foundations, the higher the probability that there is a lack of clear direction and substance behind the scenes.

Bill Anderson is optimistic and also ventures into the quintessentially German shrine. One of his main goals will be to streamline Bayer's internal bureaucracy. "We hire people from the best universities in the world, the best graduates, and then we have a bunch of people telling them what they can and cannot do. That does not make sense," he said, adding that employees need to be able to "get things done without going through five levels of approval." Streamlining bureaucracy may be a new synonym for staff cuts.

To top it off, shareholders are more than disgruntled by the turmoil of the past few years and are pushing for lasting change at the corporation. Anderson must now prove that he has the ability to solve these problems and win back investor confidence.

The update is based on the report 04/2022